Zomato's Acquired Empire

A Deep Dive into Zomato’s Ambitious Expansion Through Acquisitions And Building Super Brands

Dear Curious Investor,

When we think of businesses and M&As, we think of either an enterprise buying out competition or expanding in its own space. However, Zomato is coming out to become a company that just acquires other businesses, often loss-making to turn their stories around and give these acquisitions a new identity different from Zomato. In case you don't understand why I’m talking about Zomato suddenly, you missed out on some news.

Zomato is acquiring Paytm’s events and movie ticketing businesses. Yes, Paytm, the company that has been struggling to stay afloat since RBI broke its knees by banning its wallet business. We have talked enough about PayTM during the last year, so this time, we are focusing on Zomato and the empire it’s slowly building.

Super Brands > Super Apps

PayTM is a super app with multiple services from recharges to shopping in one app. Zomato, on the other hand, is a super brand that gives a couple of services but gets that spot on. Before we jump on to Zomato’s newest acquisition - PayTM Insider, I want to show you how Zomato acquired Blinkit and turned it into a super brand.

Blinkit when acquired was a loss-making business with a negative 50% EBITDA margin! And by the way, Zomato acquired Blinkit for a whopping ₹4400 crores two years ago. Within, these two years, Zomato’s Deepinder Goyal has proved his acquisition to be a good one as the Grofers turned Blinkit application is now India’s largest quick commerce brand with 40% market share. That said, Blinkit still stays in losses, although it’s now less than ever at a -16% EBITDA margin. However, more on the financials of Zomato and Blinkit later, first the acquisition.

Before I move ahead, remember to join our WhatsApp channel to get all Green Portfolio updates.

But why acquire?

Well, Zomato tried its hand at becoming a super app by including a grocery delivery service in the Zomato app itself but when that didn't work out, Goyal figured out a plan B (Pun Intended).

In 2022, Swiggy’s Instamart was the largest quick commerce brand in India, and Blinkit was the second. Note that I’m talking of the times before Blinkit was acquired. Now, everyone wants a share of the already evolved quick commerce business and Zomato didn’t wait until it was too late to get in on the train. Today, you see, 10-minute delivery has become the norm, Flipkart minutes, BigBasket Now, Zepto, and many other local players are coming for a share of the big sweet pie.

Now, Zomato and Swiggy are direct competitors and Zomato did not want to lose the quick delivery service war to Swiggy, and thus came into the picture, Blinkit!

Zomato, very strategically acquired Blinkit, a loss-making business, and turned it into its second-largest vertical on the basis of revenue and the fastest-growing business segment.

How Zomato Turned Blinkit Around

Acquiring a loss-making business for ₹4,400 crores was a big risk that Deepinder Goyal took. It was a much-debated subject at the time because Zomato itself hadn’t been flaring well when it came to its profits until recently. However, Albinder Dhindsa, founder of Grofers turned Blinkit continues to head the new superbrand and its acquisition by Zomato has made Blinkit the largest quick commerce brand in just two years. Let me show you how.

In the last two years, the quick commerce industry has revolutionized itself. Earlier it was just groceries that you could order, but now the catalog has widened to groceries, electronics, home appliances, toys, and so much more. Look at some numbers with me.

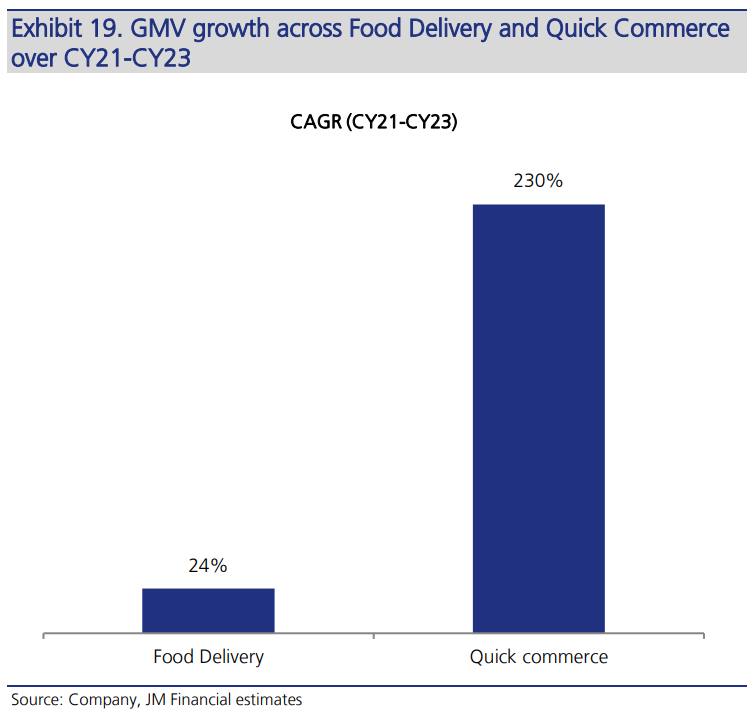

The quick commerce market has gone from a 0.3 billion dollar market at the beginning of 2022 to 3 billion dollars at the start of 2024. Ten times growth in just two years. Quick commerce vs Food delivery growth shows a huge astonishing difference, see:

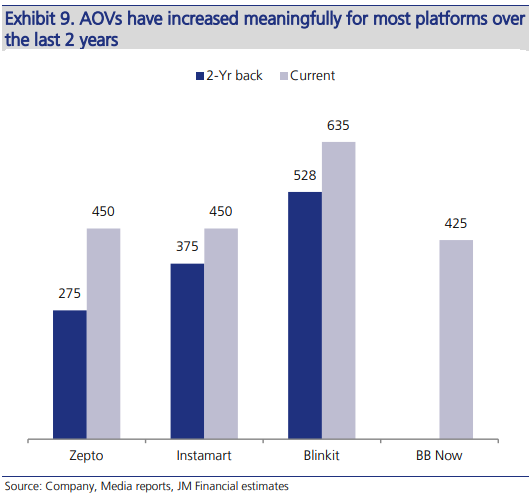

Let that sink in! Going into some specifics, come look at the AOV with me. AOV i.e. the Average Order Value is the most important metric for a quick commerce platform. With the widening range of products, like beauty and electronics, the AOV for all QC platforms has risen. Oh, and it’s worth noting that it’s the highest for Blinkit, see for yourself!

Talking about high-value orders, remember when the iPhone was once available on Blinkit? That’s how QC has been increasing the AOV, by delivering products more than just groceries. On Diwali, the QC platforms offered jewelry and gold coins too. Recently, my sister ordered a coffee machine worth ₹25,000 on Blinkit, and I’m sure you’d have ordered a high-value product in a rush from Blinkit or Zepto in a hurry too.

The Zomato advantage:

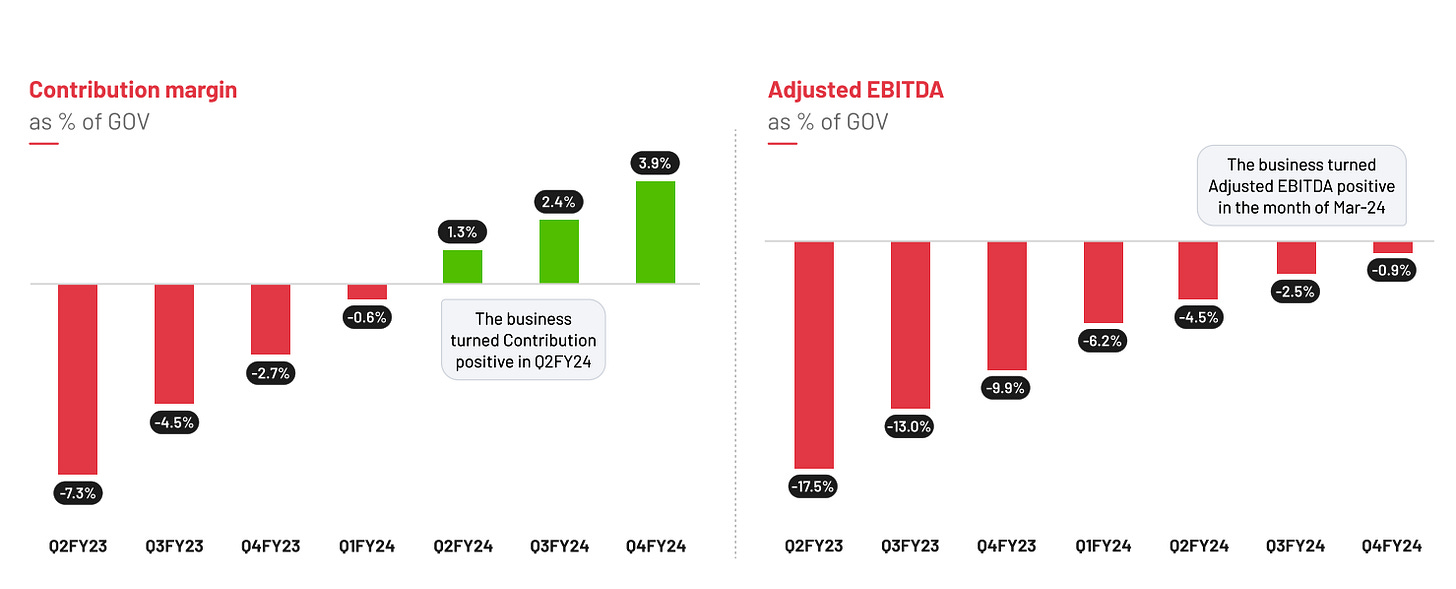

Blinkit’s super-fast growth which we now see in the last two years has been funded by Zomato. The QC app has yet to see profits from operations but it is well on track to positive numbers in Q2FY25. Blinkit getting space on the Zomato app only helped by retargeting customers to the quick delivery platform. Here are the latest Q1FY25 numbers for Blinkit:

Also, Zomato has a B2B venture called Hyperpure that Blinkit has benefitted a lot from. Hyperpure is a grocery supply chain solution for restaurants that has helped Blinkit significantly improve its margins. Read more about it here as I now finally move to the ticketing biz.

Go Out or Order In?

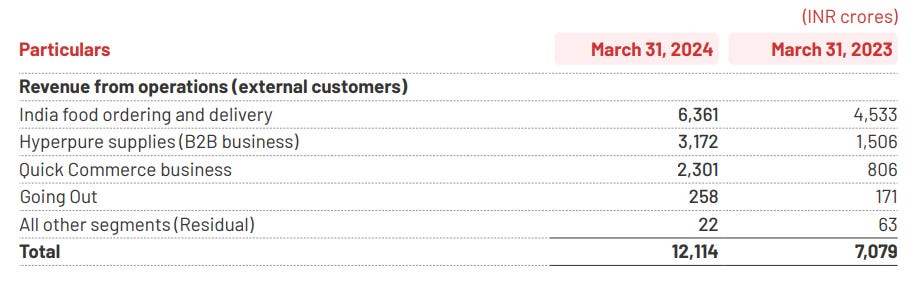

Zomato is confusing us a bit here, do you want us to go out or stay in? Let me first break Zomato’s business basic down. The listed company has four major segments: online food delivery, quick commerce business i.e. Blinkit, the B2B vertical hyperpure, and a “Going Out” vertical. The point is, that Zomato is not new to this line of business, it’s just expanding now to build District, the app that’ll host the business acquired from Insider.

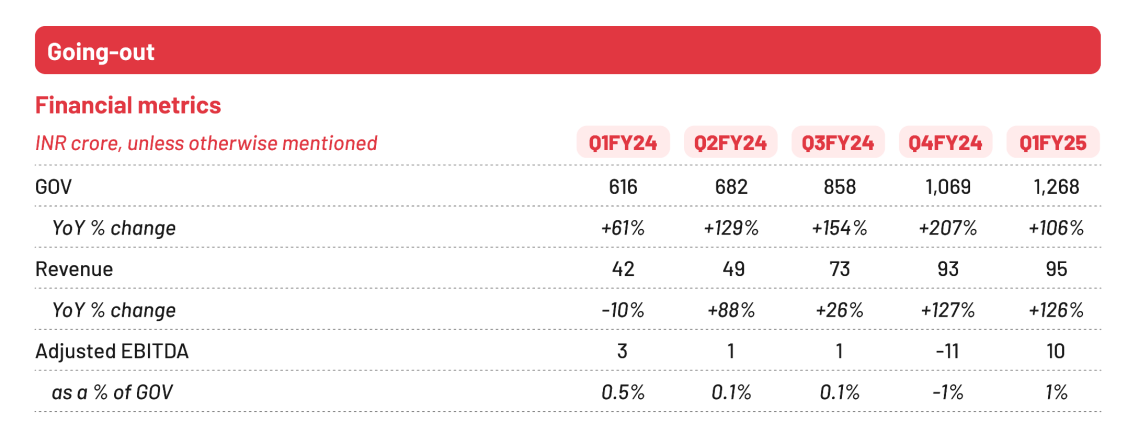

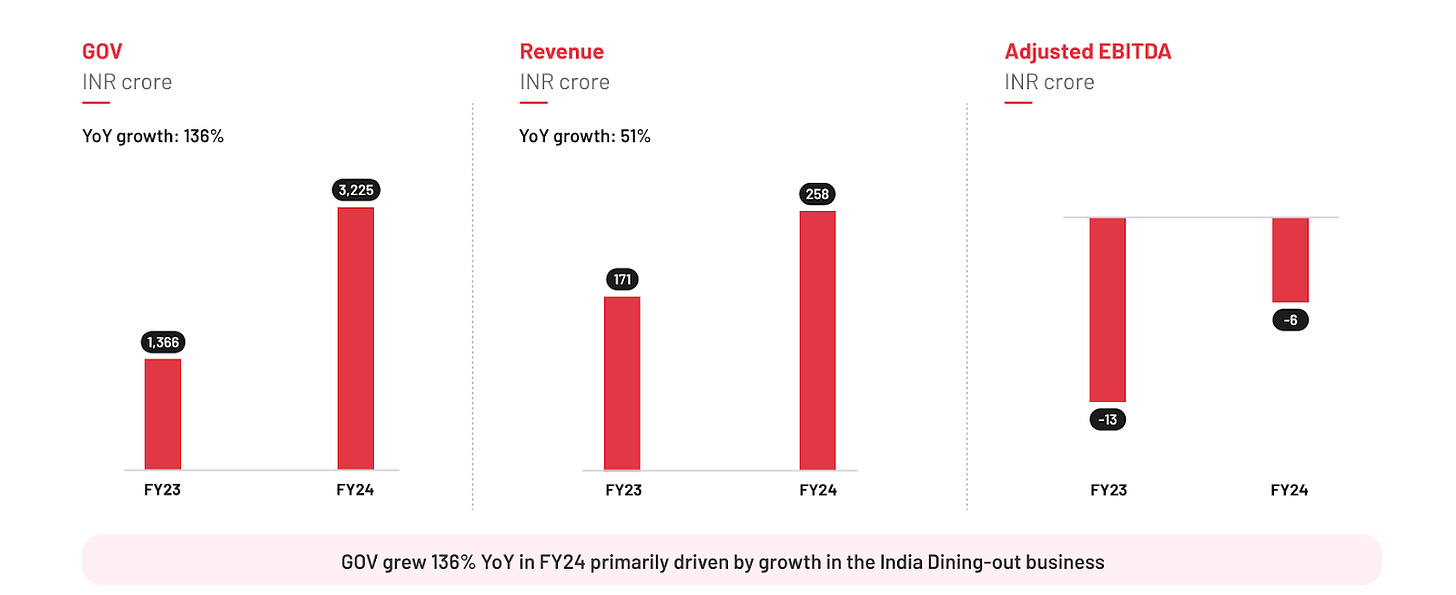

Zomato already has things like Zomato Gold which offers discounts for dining out and big events like Zomaland that it organized by itself and other events through a Zomato Live tab in the app. Here’s what the numbers have looked like until now:

“Going-out GOV grew 136% YoY to INR 3,225 crore in FY24,” said Zomato in the presentation, The vertical is not profitable but with the new acquisition, it can soon become one leading source of revenue and profits for the company. P.S.: GOV is Gross Order Value.

Zomato + PayTM: What’s The Deal?

Firstly the headline, Zomato has acquired PayTM’s Insider business for ₹2048 Cr and is building an app called District as its new super brand for the going out business. But this is just the headline, the actual deal is more complex than Zomato acquiring a part of Paytm's. What is it then?

So, PayTM owns a 100% stake in two companies:

Wasteland Entertainment Private Limited that operates Insider - the event booking business, and

Orbgen Technologies Private Limited that operates the TicketNew - the movie tickets business.

Insider, and TicketNew both work as separate applications on mobile and the web and have their own financials as private limited companies. These make for a part of Paytm’s Marketing segment which earns via ticketing business, advertisements, and more. What Zomato has done is buy away these two subsidiaries from PayTM.

Oh, and these are loss-making businesses too, just like Blinkit!

On The Going Out Businesses

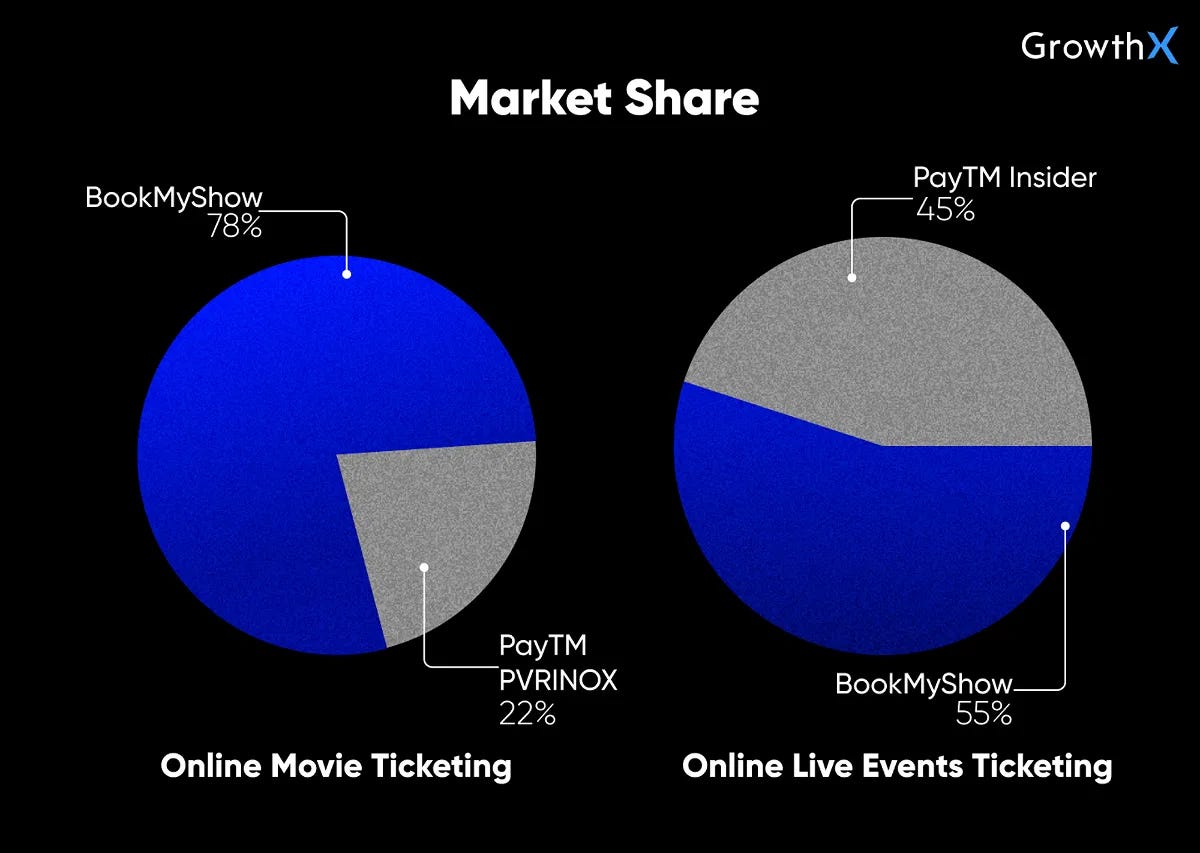

Now, why does Zomato keep buying loss-making entities? While I don’t know about that, I know that there is scope for the going out and events business. As we have come out of the pandemic, we have been seeing consumers prefer in-person experiences more than ever. I am not just saying that, I have numbers to prove it. Take the case of BookMyShow.

The company turned profitable for the first time in FY23 reporting ₹85 cr in profits and ₹976 cr in revenue. I couldn’t find numbers for the latest financial year as BookMyShow happens to be a private company, but an 8.7% net profit margin and a 13% EBITDA (as quoted by Entrackr) by the industry leader show that the industry is in a healthy space.

GrowthX did a deep study on BookMyShow in case you’re interested in the market leader. Meanwhile next up from me: Insider and TicketNew’s Financials.

Insider made ₹236.03 Cr in turnover but that came with a loss of ₹10 Cr. Similarly, TicketNew made ₹13.14 Cr in revenue but also incurred ₹4.2 in losses. Can Zomato turn this around like it’s doing with Blinkit? That’s for us all to wait and watch for.

Zomato Live and Dining Out

Zomato isn’t exactly new to the going-out business, it already has the Dining-Out and Zomato Live segments going on. Dining out works via the Zomato Gold subscription and table booking through the app and the Zomato Live via events that Zomato itself organizes. Zomaland for example, was a food and music festival that gave the company a good turnover.

Look at the numbers, here:

Also, the segment is growing at a very fast pace for Zomato itself. In fact, going out is one of its two profitable businesses as of Q1FY25. Have a look at the growth here:

Now, Zomato will put all of its going-out business, which will include movie ticket booking and live events, all under one app - District. The app that’ll now be the competition to BookMyShow.

Also, the news is that we’d be able to buy tickets for live events way ahead of time and sell them later. I love the idea of this but let’s see how it pans out.

Zomato is building its empire brick by brick while PayTM has to sell its’ wall by wall.

Another possible angle for growth - Entertainment and Food, which always go together. As you might know, a major chunk of revenue for entertainment businesses, such as movies, comes from their F&B segment. One can only imagine the possibilities in this space. It’s all on the consumers now and it looks like the District app will be received well (particularly with Zomato’s marketing).

There’s a lot more I’d like to talk about Zomato, quick commerce, F&B, and entertainment, I’ll leave that to another day for brevity.

Introducing New smallcases

Well, talking about consumerism, we have been seeing India become the flag-bearer amongst consumer-driven economies lately. Seeing the massive growth India is getting in some sectors and areas, we created three new advisory portfolios concentrated around specific sectors. We launched them just a couple of days ago marking another small step in our big journey.

Let me tell you about the portfolios. We have three portfolios:

GDR - Green Energy, Defense and Railways

Pharma Select (for the pharmaceuticals sector)

Auto Advantage (for automotive)

The names are pretty self-explanatory so I won’t take too much of your time talking about each strategy here, but you can read more about them here and watch the launch live here if you’d like to.

We’re also running a rare 30% introductory discount on the subscription of these new smallcases till September 10, so hurry if you want to use the offer. The code is LAUNCH30 and it’s only valid for two more days.

From the Wise Investor 🤓

"Opportunities don't happen, you create them." — Chris Grosser

Opinion Corner

What do you think—will Zomato’s latest acquisition turn out to be as successful as Blinkit? Share your thoughts in the comments!

That’s all I have for today, see you again soon!

Yours truly,

Isha Bansal