Is The Stimulus Package Enough For China?

Chinese Economy: Bouncing back from the trenches?

When COVID-19 hit the world in 2020, it impacted everything. Many individuals and economies have still not been able to recover. The prime example of economies in shock is China, the place where it all started. The Chinese economy went into a downturn (like everyone else) but after four years, it is still in a slowdown. While most countries slowly opened up their lockdowns, China proudly stayed in one for the longest time. It was good for dealing with the pandemic, but it left the economy in a terrible state. Now, to stir things up for the economy, the Chinese government has announced a hefty stimulus package. This package has a wide range of schemes to get the economy running again. However, the scope of this stimulus package doesn’t match the scale of problems China is currently facing. Let’s start by understanding what the crisis is all about.

China’s Biggest Ailments

The Chinese government has set a target rate of 5% GDP growth for 2024 and so far, it is way out of sight. Consumption, retail sales, property market, and unemployment, are all parts of the big problem.

The Big Fat Real Estate Market

Property is a huge problem in China. And it’s not because there’s not enough of it, it’s because China has housing that can accommodate all of its population twice! Real estate accounts for 25% of China’s GDP, and of late, it’s been turning into a problem. Households own multiple homes and now there is so much supply of homes in China that their prices have been dropping every single month. Look at this chart:

The gradual drop in prices you see above is a problem because 60% of the household wealth in China is kept as property! And you never expect the prices of a house to go down after you buy it, right? Sad times for Chinese homeowners.

Consumption Crisis: Deflation

Remember how Japan has been in deflation for a long time now and it’s been terrible for the economy? I talked about it just a few days ago here. The point is that deflation, or very little inflation is bad for the economy. It reflects the lack of demand in the country, and we all know that economies run on consumption.

See how China went into deflation a year ago and is still at just 0.4%. Oh and by the way, China’s long-term target inflation rate is 3%, long way there! Other indicators that reflect consumption like retail sales and industrial output have been on a downturn too.

Unemployment

We all know that unemployment is bad, obviously and the economies see more unemployment during downturns. When there is no consumption, the industrial output drops and since there’s not much work to be done, no hiring occurs. Not to forget layoffs and pay cuts due to reduced profits in the hands of the country. In fact, unemployment in China increased so much that the Chinese authorities have stopped reporting the data altogether! Here’s the little that’s available:

Let’s see how the Chinese government is trying to fix this.

China’s Stimulus Package: What’s the Buzz?

Buckle up for this because this stimulus package is like China’s economic superhero cape, swooping in to save the day! With a mix of cash, and policy incentives, this package aims to rev up the economy and keep things humming along.

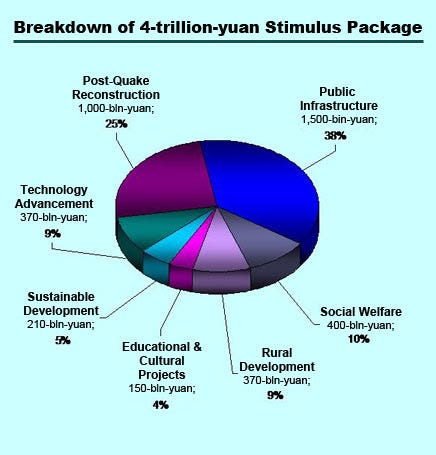

What’s Inside This Stimulus Package?

Think of the Chinese government as a kid in a candy store—only instead of sweets, they’re spending big bucks on infrastructure and public works! From shiny new roads to bustling urban development. All this spending is aimed at jumpstarting the economy and getting people back to work.

Monetary Easing: Time to Loosen the Purse Strings!

The People’s Bank of China (PBOC) is taking bold steps to give the economy a much-needed boost. They’ve decided to slash interest rates by 0.25%, bringing the one-year Loan Prime Rate (LPR) down to 3.45%. LPR is the lowest rate at which you can get a loan if your credit score is amazing. This is a significant move, as lower rates make borrowing cheaper for businesses and consumers alike.

Additionally, the reserve requirement ratio (RRR) for banks has also been reduced by 0.25%, which translates to around 500 billion yuan (approximately $70 billion) being pumped into the financial system. The RRR is the amount of money banks are required to keep on hand with themselves. A lower ratio means less funds to keep in banks and more to lend out to businesses and consumers. With more cash flowing around, companies can secure loans more easily, and consumers might feel empowered to spend more. Some say this could potentially lead to a 1% GDP growth increase in the short term—definitely a positive sign!

Source: Reuters

Helping Small Businesses

Let’s talk about Small and Medium Enterprises (SMEs) - the real backbone of our economy. The government is stepping in with a stimulus package designed to help these businesses thrive. They’re rolling out 300 billion yuan (about $42 billion) in grants and tax breaks aimed specifically at SMEs. One exciting aspect of this initiative is a 50% tax reduction for qualifying small businesses, which can ease their financial burdens significantly. Plus, they’ll have easier access to low-interest loans, reducing their costs by up to 40%. This support is set to stabilise over 30 million SMEs that have faced challenges during these tough economic times. It’s like a superhero swooping in to save the day!

Consumption Incentives: Shop ‘Til You Drop!

To get people excited about spending again, the government has introduced some attractive incentives. They’ve earmarked around 200 billion yuan (about $28 billion) for cash vouchers that consumers can use to make purchases. For example, you could receive a voucher averaging 1,000 yuan to spend on electric vehicles (EVs) or new homes. If you’re considering an electric vehicle, there’s even a subsidy that could be as high as 20,000 yuan! After seeing a 5% decline in EV sales last quarter, these incentives are aimed at revving up consumer interest and spending. This push could lead to a 15% increase in consumer spending in the coming year, which is exciting news for retailers and the economy as a whole.

Source: eeo.com

Export Support

China isn’t just focusing on boosting domestic consumption; they’re also keen on enhancing their exports. They’re increasing export tax rebates by 10% as part of the stimulus package. This means that manufacturers can now claim back up to 17% of the taxes they’ve paid on exported goods. This support is crucial, especially in the face of rising trade tensions, as it allows Chinese products to remain competitive on the global stage. The government is aiming for a 6% increase in export growth this year, which would certainly help many businesses thrive internationally.

Financial Sector Support: Keeping the Banks Afloat!

Lastly, we can’t overlook the importance of a stable banking system in this recovery plan. The government is taking measures to support banks by allocating 1 trillion yuan (around $140 billion) to recapitalize them and prevent defaults. This support includes loan facilities aimed at bolstering bank capital and ensuring that non-performing loans (NPLs) remain below 2.5% of total loans. By keeping banks stable, the government is helping maintain consumer and investor confidence—essential elements for a thriving economy.

These measures demonstrate a proactive approach to economic recovery, and as these changes take effect, we can expect to see positive impacts across various sectors. Stay tuned for more updates as these developments unfold!

Real Estate Saviour: 25% market stake to sway!

People don’t need hotels to live ‘cause they’ve got more roofs than the heads. LoL. Seriously, China has a lot of houses - more than twice its population. And consequently, the real estate prices haven’t been really impressive. So, to pump this plummeting real estate situation, the Chinese government is trying to pump in some more demand by reducing the minimum down payment to 15% for first-time home buyers and 25% for second-time ones.

What’s the Goal of All This?

So, what’s the grand plan behind this stimulus package? Here are the main objectives:

Economic Stabilisation: The immediate aim is to keep the economy steady during bumpy times. By injecting money and increasing government spending, the goal is to avoid a major downturn.

Job Creation: With more infrastructure projects and support for SMEs, the hope is to create tons of jobs. After all, a happy workforce is a productive workforce!

Boosting Domestic Demand: China wants to shift gears from being heavily reliant on exports to boosting domestic consumption. More spending at home means a more sustainable economy.

Building Resilience: Given recent global challenges, this stimulus package aims to make the economy more resilient, ready to tackle whatever surprises come next.

Given the size of this package and the rally and FII inflows Chinese markets have seen in the last two weeks, one would think that the stimulus is a magic wand. However, it will take China a long time still to see the light of day because the economic problems are even larger in scale and it’ll take a few more stimulus packages for China to stabilize (let’s not even talk about growth right now).

From the Wise Investor 🤓

“The ability to borrow is the ability to make money.”

Let’s see how much the people of China will borrow and whether it leads to wealth creation!

P.S.: This edition has been collaboratively written by me, your usual writer Isha, and Saksham, a team member who’s just recently become fond of newsletters. Let us know how you liked this one!

That’s all from us today, see you again soon!

Yours Truly,

Isha & Saksham

Very good article.China has to go long way.It is a carpet.We don't know how much dust has been accumulated due to Real estate bubble.

It's very useful. Thank you.