Consequences Of Rate Cuts

Understanding the ripple effects of interest rate cuts on the economy, equities, and other asset classes.

Dear curious investor,

The Fed finally cut overnight interest rates on September 17, and a series of events in the global markets have followed since. And I don’t mean just equities, from gold to bonds to currencies, everything has been affected. For over two years, the Fed has hiked rates repeatedly to control inflation which went up to nearly 9 percent in the states. Now, after many cycles of tightening the monetary policy, inflation is finally under check, and the economic environment called for some rate cuts.

In this edition of Perspectives, we are looking at the impacts of the latest rate cuts by the Fed, and its implications on the US economy, different asset classes, and Indian markets. Let’s dive in!

The Basics

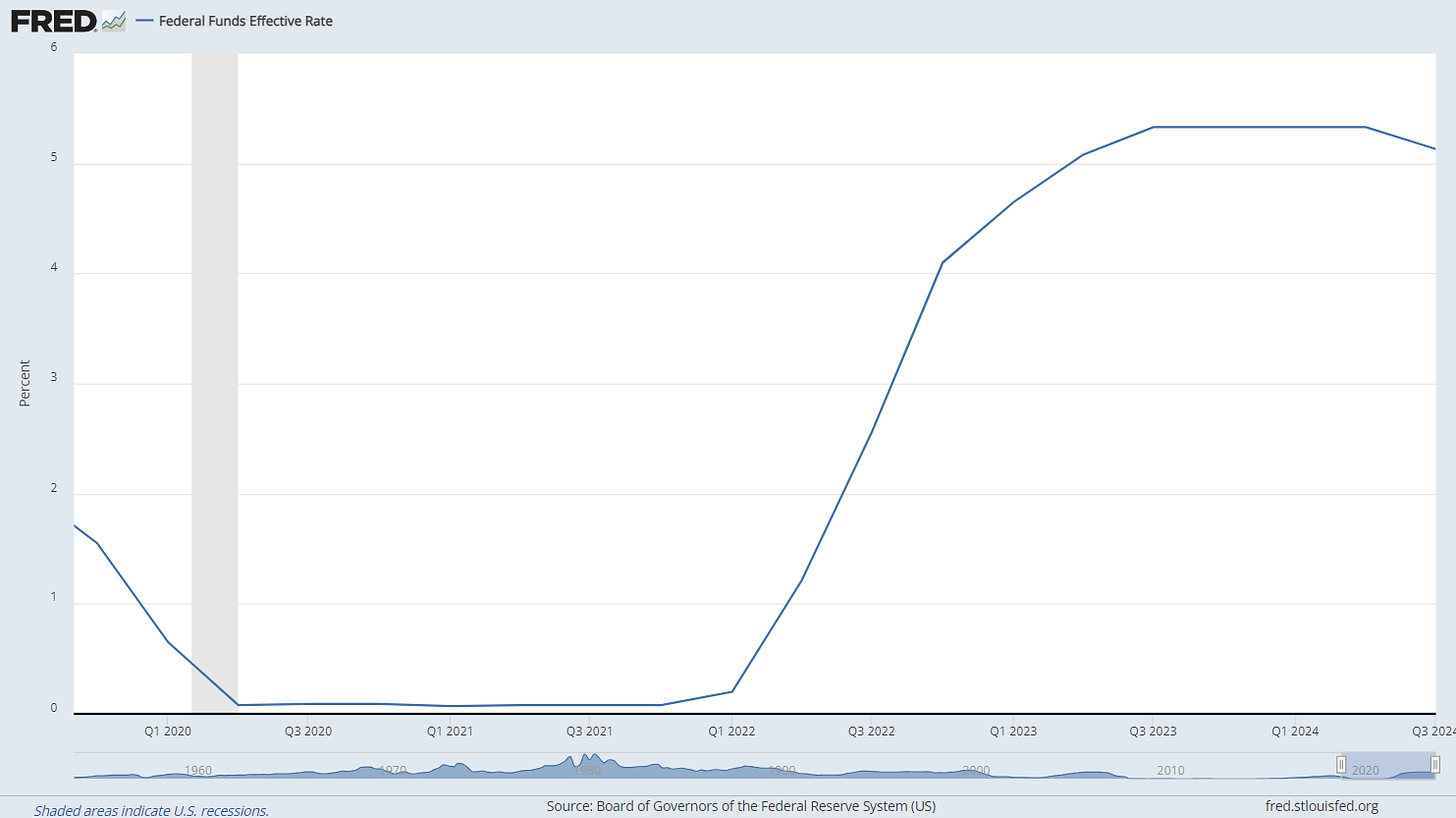

First, let’s understand what interest rates mean here and how they function. Whenever we talk about interest rates on a broad economic level or in conversations about the central banks, we usually refer to overnight rates. This is the rate at which banks borrow and lend money amongst themselves for very short periods. It affects everything: mortgages, car loans, credit card payments, and even the savings account interest rates! This phenomenon applies to almost all economies around the globe. Essentially, central banks change one rate and that rate decides the course of the economy. Here’s how the Fed has changed interest rates in the US for the last five years:

So, When Are Interest Rates Altered?

A quick Google search will tell you that “A central bank's primary function is to control a country's money supply and credit to achieve price stability, a stable economy, and financial stability”. Understand that it’s the responsibility of central banks to make sure that inflation stays in control, that consumers and businesses are able to borrow money at a comfortable cost, and that the finances of the economy stay healthy.

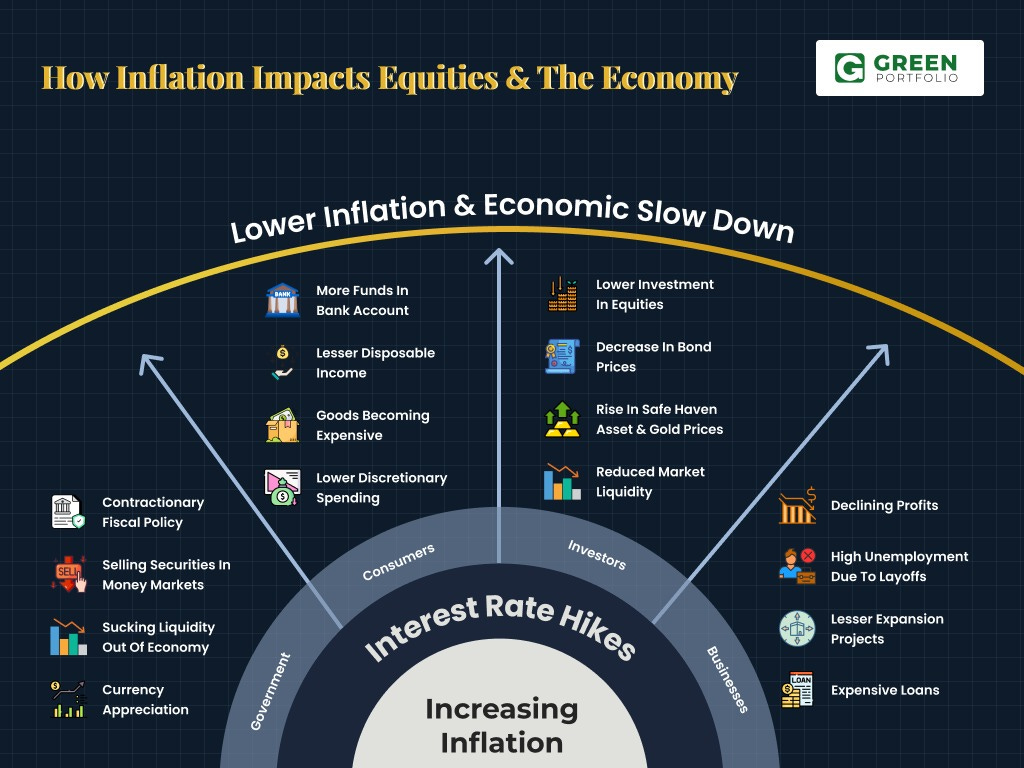

Now there are a lot of things that can determine the economic health of a country like inflation, GDP growth, credit availability, employment, etc. When one or some of these things go haywire, the central bank looks at altering some things to correct the economic imbalance. There’s a fair number of things that a central bank can do to shift things around, this includes changing the interest rate, buying and selling foreign reserves, trading bonds in the open market, and so on. Basically, interest rates are altered when the central bank needs to influence a change at the macroeconomic level. Here’s how increasing inflation and rate hikes play out in an economy:

P.S.: Investors on our WhatsApp channel learned this weeks ago, join the channel to stay in touch with us!

Now, let’s see which economic indicators make the central banks alter rates.

Fed’s Dual Mandate

What a central bank does to stabilize the economy depends on its mandate. The mandate is simply an instruction statement or set of guidelines defining the primary responsibilities of the central bank. America’s central bank - The Federal Reserve has a dual mandate, i.e. it has two primary functions:

Maintain stability of prices AKA comfortable inflation levels

Ensure maximum level of employment

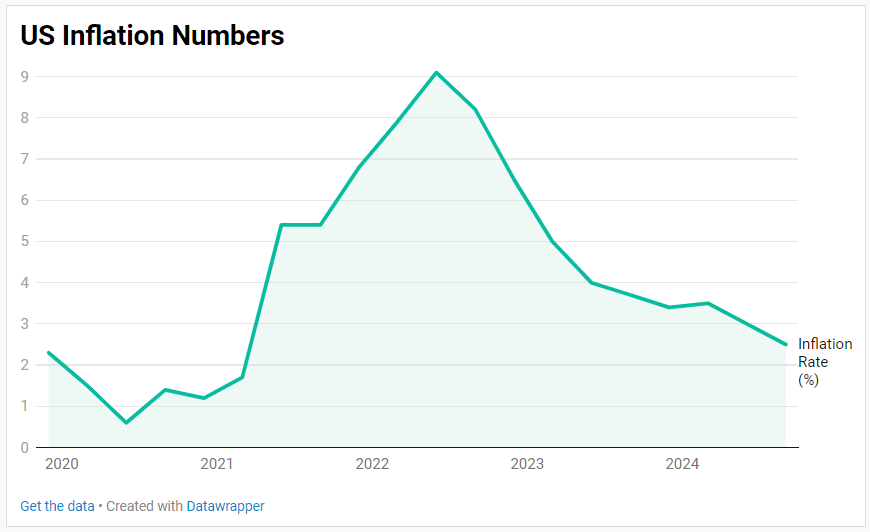

The former led to rate hikes and the latter rate triggered rate cuts. Let me tell you how! Back in March 2020 when COVID-19 hit us, all economies around the world started going down. Every country dealt with this in its own way. The US chose to print money and cut interest rates to aid borrowing, and spending, and maintain financial stability. So the last time the US cut rates, we were witnessing a pandemic. This was fine, nearly every country did this in an effort to fight the pandemic but rate cuts for the US were followed by very high inflation. In a span of just a few months, inflation in the country went from about 2% to more than 9% - way above the Fed’s target of 2% and that led to big havoc.

Here are the inflation numbers for some context:

With rising inflation, the Fed was now under pressure to fix this one-half of its mandate. Thus started the cycle of rate hikes which slowly brought back the equilibrium and eased inflation. Starting in March 2022, the Fed raised interest rates 11 times to go from 0.0-0.25% in March 2022 to 5.0-5.25% in July 2023. In a nutshell, the Fed raised interest rates to fight inflation.

Why Cut Rates Now?

So the said one-half of the mandate was taken care of as the rate hikes brought down inflation, but it also led the country to an economic slowdown. Consumption has been going down in the economy, real estate was turning lukewarm, the job market has been slowing down and unemployment reached a three-year high of 4.3% back in July.

So, the other half of Fed’s mandate, i.e. ensuring maximum employment came under the spotlight. Increasing unemployment, economic slowdown, and the global economic conditions: everything hinted at the need to cut rates. I am still not sure why the Fed delayed the rate cuts despite an easing inflation but a significant 0.50 cut is here now. This is just the first of the cycle, the bank will continue to decrease rates over several months to bring the rate to a comfortable level. These rate cut cycles are what affect all the asset classes and global markets. Let’s explore how!

Bond Yields

To understand how interest rates affect asset classes, we first need to know how interest rates and bonds behave. The central bank trades bonds in the open market to conduct its monetary policy. Bond yields i.e. the interest you get for holding bonds fall when the overnight rates are reduced. Bond yields have gone from 4.9% in Oct ‘23 to 3.8% now, and this seemingly small 1.1% change in bond yields is very significant.

Debt in general and particularly government bonds serve as a safe investment option in turbulent economic conditions. However, dropping bond yields lead to funds migrating from bonds to other asset classes. So, when the Fed increases interest rates, bond yields rise, and investors flock from other assets like equities and commodities to bonds, for both safety and stable returns.

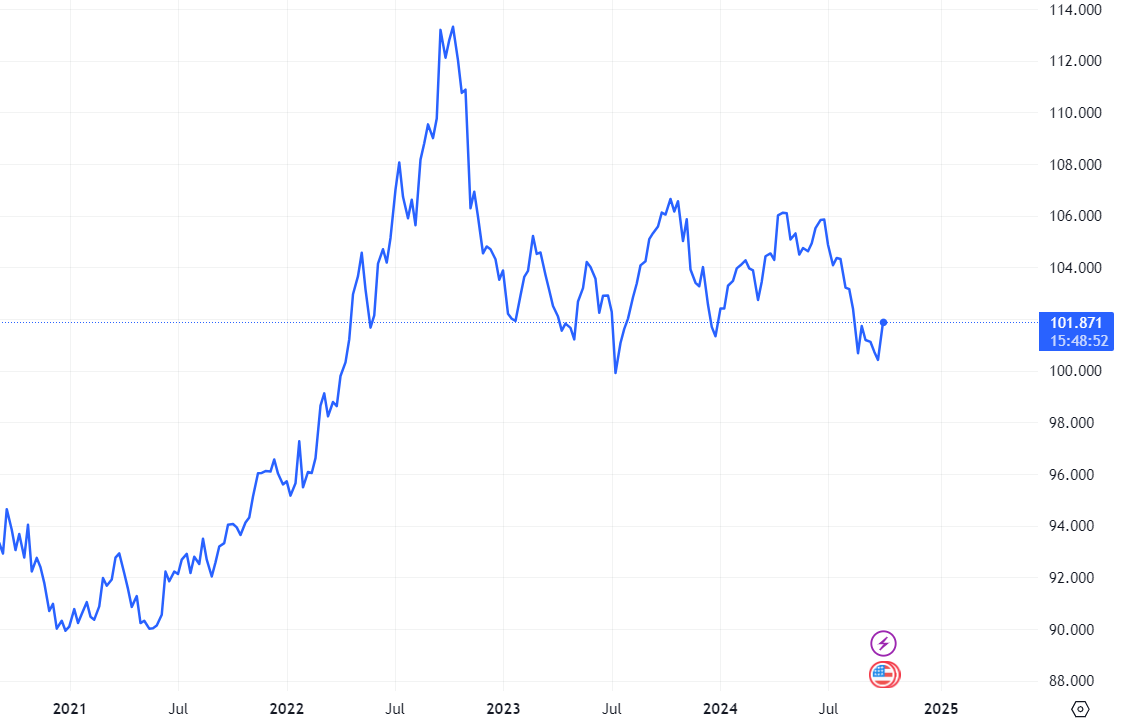

The US Dollar

Currency and foreign exchange rates are very important when it comes to foreign flows, imports, exports, and more. When interest rates are decreased, returns on US-denominated assets like bonds, and treasury bills reduce too. Thus in the case of the US, investors would withdraw funds from US to invest in countries where interest rates are higher like India! As the demand for domestic currency reduces, we see the currency depreciating. The dollar index, which measures the value of USD against a basket of other currencies is indicative of this depreciation, and it has gone from 107.1 last year to 101.9 now.

Carry trades, i.e., borrowing funds from countries where interest rates are low and investing in the countries where they are high also negatively affect the value of the dollar as rates go down. But depreciation here is not necessarily bad, in fact, it boosts exports as they become cheaper, and higher exports add to the economic health of the country.

Gold At All-time highs

Next Up: the shiny metal that has been making headlines. Gold is again one of the safer investment options but it behaves unlike bonds. In fact, it acts as an alternative to bonds when yields fall and that is exactly what we are seeing now. The value of USD also comes into play here (and everywhere else too). When countries trade gold with each other, they do it using the USD. A weak, depreciating dollar makes gold a little cheaper for buyers, and that has significantly increased the demand for gold. Being a safe haven asset and acting as a hedge against inflation only increases the demand for gold in the current global economic uncertainties and geopolitical tensions.

What’s In Store For India?

Remember the money that’s being withdrawn from American bonds and the USD carry trade? That money migrates to other countries, particularly emerging markets like India. We are seeing a good market rally ever since a rate cut was expected in the FOMC meeting, foreign investors who were once selling are now coming back. Sensex crossed a new high of 85,000 points and FIIs turned positive buying 12,000 Cr in September. This is true for not just India but most emerging markets as investors have started pulling money out of the US. We have more benefits from the rate cut here in India.

The US is India’s biggest trade partner. So, the now expanding US economy opens a lot of avenues for us which were shut off until recently. It makes the imports cheaper and indicates a higher volume of exports with increasing consumption in the US. And we have some industries that are almost dependent on the US for their orders, IT is of course the biggest example here. Thus, as the rate cut cycle continues, we are expecting to see an increase in orders and investments from America.

While we saw our markets rally right after the Fed announcement, the real impacts of the rate cuts will be seen after it has been decreased many notches, which will only happen slowly and over multiple meetings of the Fed. India happens to be in a great position here as our economy has shown a strong resilience to global uncertainties but at the same time, is expected to benefit from the rate cuts.

From the Wise Investor 🤓

“Time is your friend; impulse is your enemy.” — John C. Bogle

That’s all I have for today, see you again soon!

Yours truly,

Isha Bansal

Informative!