India’s Big Fat SME Space

Indian SME IPO market is booming with oversubscriptions and exuberant listing gains, but concerns over weak fundamentals and market manipulation persist.

Dear Curious Investor,

Visualize something with me and imagine a company called ABC coming up with an IPO, an SME IPO. This company is into the production of flour, spices, oils, and a bunch of other food products, and is raising a small amount of funds - merely 5.5 crores. The desi North Indian in me would say it’s just a chakki coming up for an IPO (oh and this company operates in Delhi-NCR too). I know it’s a tiny IPO but it is a public issue still, so let’s talk financials. Stating a little over ₹12 crore as revenues in the RHP, the company reports single-digit OPM at 9.75%. It’s offering a lot for ₹1,44,000 with each share being ₹48.

Now, given that you would 100% get the allotment but with the condition that we forget about listing gains for once and focus on the company’s fundamentals, tell me this:

I don’t know about you but I know I wouldn’t apply with such little knowledge of the fundamentals, rather bleak fundamentals, and such a big risk. But, here’s the googly, this is not some imaginary company ABC, it is actually a company called HOAC Foods India Ltd that came up with an IPO and got oversubscribed 2,000 times! Imagine asking for 5.5 crores and being offered 11,000 crores. Simply insane. I say this with the utmost respect and very little knowledge of the markets (like most retail investors) that this company’s fundamentals are not something to be put up on the pedestal, at least not yet. The 2,000x oversubscription for such a small issue size made HOAC’s shares list at more than a 200% premium! Again, simply insane. Now, I ask you again, would you apply?

I’m sure you’d have guessed by now that today’s topic of discussion is IPOs, in particular, SME IPOs. Today, I am taking you through the details of India’s Big Fat SME Space.

The SME space has become increasingly popular during the last couple of years, and so have IPOs. Combine the two and you have a cult favorite - SME IPOs. This year has been an upward sprint for the SME space and as advocates of the small-cap space, we’re here for all the fuss. However, there are some issues too that we cannot just turn a side-eye to and I am talking about both today.

2024: In SME IPOs

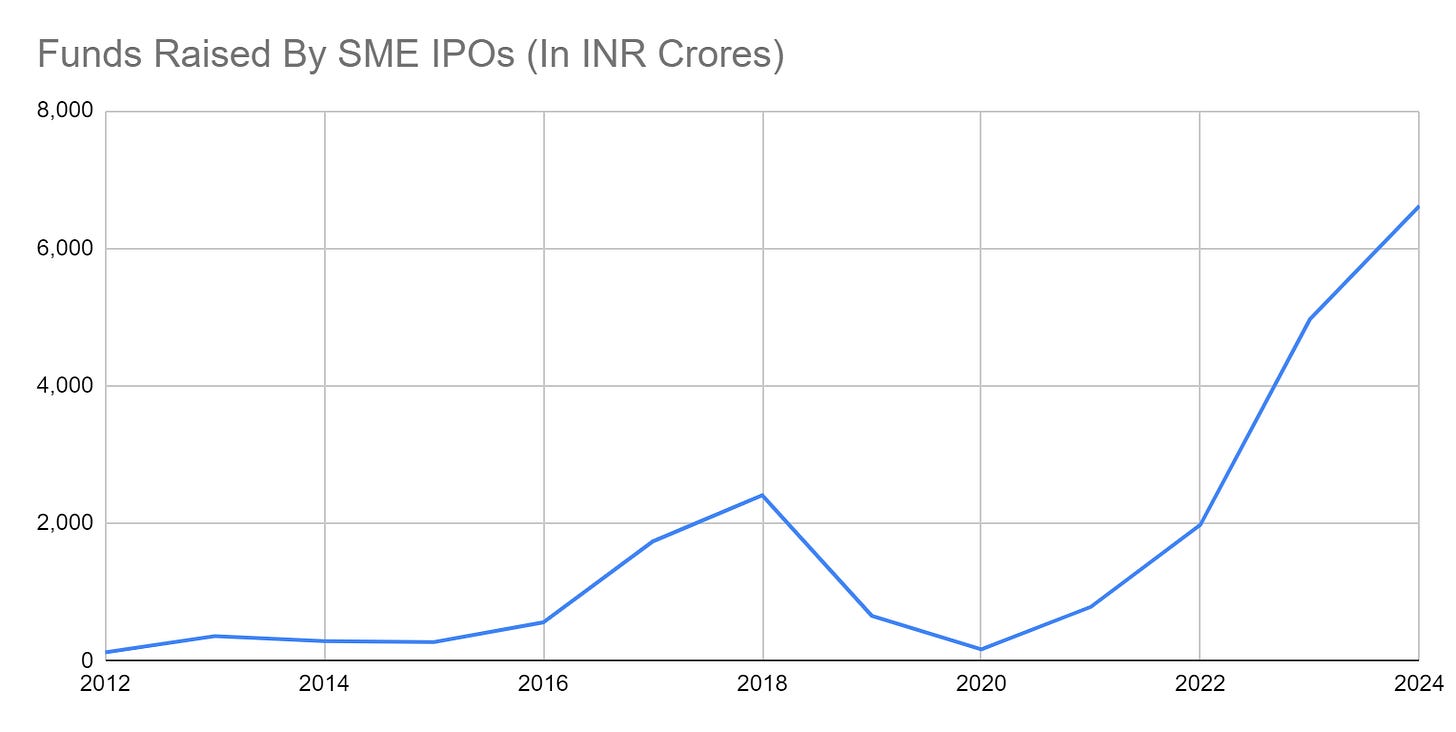

SME IPOs were first introduced as a category in 2012 to facilitate newer funding options for Small and Micro Enterprises, aka SMEs. Since then, Indian markets have seen 1074 SME IPOs raising over 20,000 crore rupees. It started with just 14 IPOs in 2012 and this year we’ve had 184 IPOs already, and the year has not even ended yet. More than 30% of these funds, i.e. ₹ 6,000 crores have been raised this year itself. One whole quarter is left and 2024 is already the year raising the biggest amount via SME IPOs, see here:

While this is great progress for the SME space, it is concerning for the investors.

Currently, Liquidity > Fundamentals

134 of the SME IPOs that were listed were oversubscribed more than 100 times and about 25 of these oversubscribed more than 500 times. Now I haven’t analysed all of the companies being listed but what I can say for sure is that it’s definitely not the fundamentals driving these subscriptions. What we are witnessing right now is a bull market and well, almost everything sells in a bull market. Combine that with the liquidity coming in the markets and we have the super-enthusiastic everyday investor ready to apply in every IPO out there.

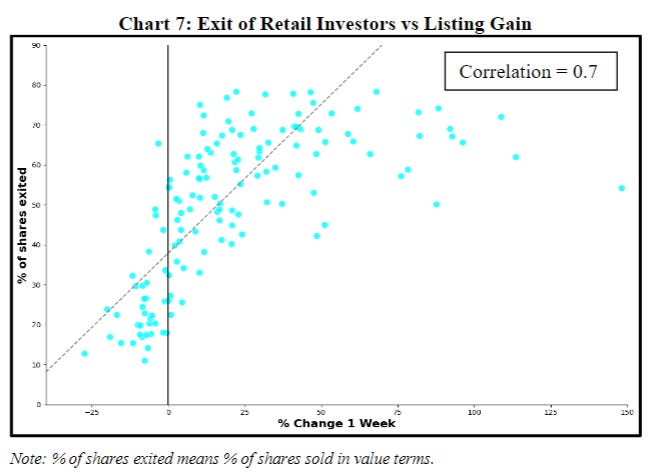

The visual above may look complicated but it simply shows that the higher the listing week gains, the higher the exits made from allotted shares. At the cost of sounding too blunt, I’ll come out and say that a lot of investors are solely investing for listing gains at this point.

S&P BSE SME IPO Index

Did you know that there is an index that tracks the performance of SME IPOs specifically? Well, I didn’t, and neither did I know that this index has given more than 160% returns in the last year! I don’t know about you but I was thrown off by this information, I even looked if there’s any ETF tracking the index but obviously these are SMEs, and I didn’t find any such fund. Also, this is the first Indian index to cross the 1 lakh points mark!

This index tracks about 60 SME IPO shares from their listing day. While the returns are absolutely stellar, the valuation is concerning with a Price-to-earnings, i.e., PE ratio of 65!

However, what this index doesn’t track is the shares that are not doing that well, so I did some digging myself and found that about 50 of the listed companies, which translates to around 25% of the companies. There are companies trading at a 60% loss and those trading at a 600% profit. These extremes have gotten everyone worried.

Of late, there’s been a popular discourse on whether such small issues should be allowed or not, let’s see how the regulators are (re)acting to control the apparent “frenzy”.

SEBI’s Actions To Regulate SME IPOs

When we see a frenzy as berserk as what we’re seeing right now, the regulators are faced with the question of controlling it. Chairperson Buch too has repeatedly given warnings around the SME space. SEBI has been fairly vigilant itself seeing the markets of late, and as one would anticipate, it has come up with some regulations as a starter (don’t worry, increasing the ticket size of lots is not one, at least not yet).

Trafiksol ITS Technologies Limited, a very recent that was subscribed 345 times, had a grey market premium of 135%. Straight up multibagger! However, this was before listing. On the listing day, BSE found some unresolved queries postponing the listing. And now, the GMP stands at 0. My condolences if you got the allotment!

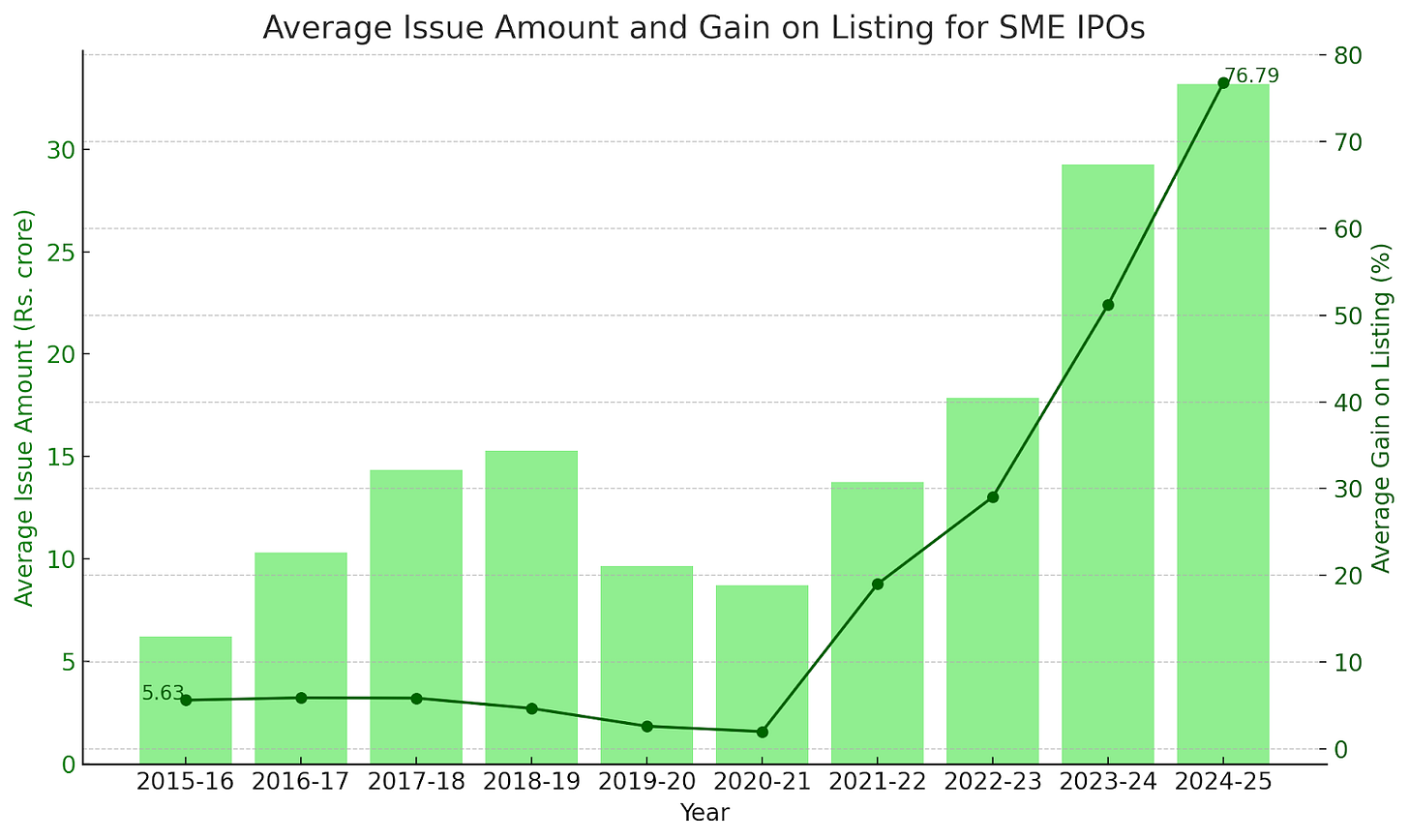

The average issue size and listing gains over the years have increased dramatically over the last decade, and everything just points towards a problem. Here’s what I mean:

Currently, the SME IPO process is not regulated by SEBI but only by the stock exchanges, i.e., NSE and BSE, but many investors have been rooting for SEBI’s oversight in the process. And of course, SEBI is worried about investors falling for malpractices and price manipulation by promoters, here’s what a recent notification said:

“However, it has come to the notice of SEBI that, post listing, some of the SME companies and / or their promoters have been resorting to certain means that project an unrealistic picture of their operations. Such companies / promoters have been seen to make public announcements that create a positive picture of their operations. These announcements are typically followed up with various corporate actions such as bonus issues, stock splits, preferential allotments, etc.”

I have some reference for you. Back in May, a company called Varanium Cloud Limited became the subject of SEBI’s surveillance. It came up with an SME IPO in 2022 and the share prices fared well for a while. The company said it’ll use the IPO proceeds for “expansion and general corporate purposes” and it did that, to a very small and unverifiable extent. What came out after verifications by SEBI was a whole lot of lies and related party transactions. This is one of the reasons behind SEBI being scared for investors and an instance of the consequences SMEs can face.

Now in order to control more events like that of Varanium Cloud and restrict companies with poor financials from the markets, NSE just made it necessary for the SMEs coming up with IPOs to have positive free cash flows from equity for the last three years. This is applicable starting September 1, 2024, and this is going to be a problem for many companies. Remember HOAC Foods Limited, the company that I talked about earlier? Well, that company wouldn’t have been able to list if it was this month because it had negative cash flows just last year.

Additionally, NSE has also capped listing gains in the special pre-open sessions to 90%. No more 3x-5x returns. :(

SEBI just came up with a study showing that most investors exit their positions in the first week of listing, this study underscores the rising concerns around investor behavior, and another consultation on proposed regulations is expected this year.

Fun Fact: The quoted study by SEBI also highlights that 39.3% of the retail investors getting allotment are from Gujarat!

The same study shows that almost half of the demat accounts that are being used to apply for IPOs today have been opened post-COVID-19. This finally brings us to the question

Is It A Bubble Waiting To Be Burst?

SMEs are surely benefitting from the investor sentiment. Every public offering gets fully subscribed and the company gets fresh liquidity. Merchant bankers, i.e. the people who connect the companies and investors are earning big. The investors who get allotments and are able to sell off their holdings in the first week of listing are winning too.

So, why the heck do I have a problem here? Well, my problem is not the enthusiastic investor sentiment, the issue is that equity markets are being looked at as a form of gambling. We are investing with less than a one percent chance of getting an allotment after looking at just subscription numbers. As a retail investor, applying to IPOs solely may not be a very sustainable practice over a long period. The humongous IPO applications are just an indication of the greed that’s now prevailing.

All of that said, we are seeing some fabulous fundamentals and business models coming up via SMEs. Take waste management, drones, or healthcare, the problem is not that more and more companies are coming with IPOs, but how investors are receiving these without any scrutiny. And whether it is a bubble or not remains a matter of time for us to see.

From the Wise Investor 🤓

"The stock market is filled with individuals who know the price of everything, but the value of nothing." — Philip Fisher

Opinion Corner

Do you think SEBI’s new regulations will dampen investor enthusiasm for SME IPOs, or will the market continue booming regardless?

That’s all I have for today, see you again soon!

Yours truly,

Isha Bansal

Valuable information to learner

I found this post incredibly insightful, great perspective!