What’s Happening To The Rupee?

Exploring why the value of INR has been falling and what it means for India

Dear investor,

Unless you’ve been living under a rock, you’d know that the value of the rupee has been going down. It now costs INR 84 to buy one USD! Your next trip to America has become more expensive than ever now. The Indian Rupee is under a lot of pressure coming from all sides. China’s stimulus package, the US election, global geopolitics, and more, everything is influencing the rupee for the worse. In this edition, I am exploring all the factors dampening the value of the rupee to see how much of it affects a retail consumer/ investor.

What’s happening?

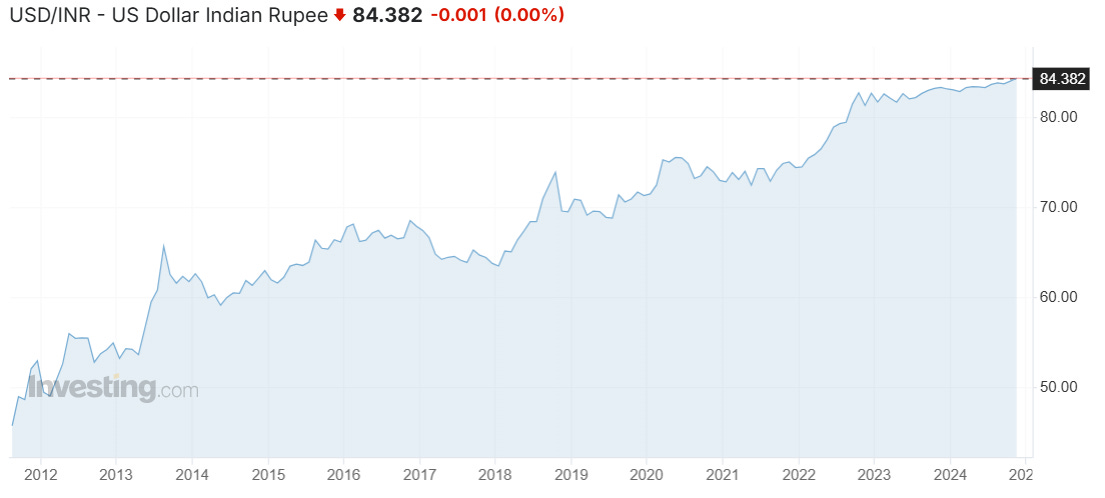

Look at the trajectory this chart shows:

You won't even have to look closely to infer that the value of the rupee against the dollar has been going straight down for over a decade now. Just 5 years ago, it would cost about ₹70 to buy 1 USD, but now you need ₹84 to buy that same dollar. This is a depreciation of over 20% in just five years. Remember, that this depreciation comes despite the fact that India has been growing fantastically over these last few years.

Everyone wants to trade with India, but no one wants to settle that trade in Indian Rupees. All the trade we do is settled in either US Dollars or Euros or Chinese Yuan or UAE Dirhams or another currency, but not the Indian rupee. And that is the whole problem.

Why Does It Matter?

The value of the rupee is crucial to be maintained because India is a net importer of goods. Since India is an importer, we need a lot of foreign currency like the US dollars to settle trade, and when the rupee loses its value, these imports become more and more expensive. We have to make payments to other countries in currencies like the dollar and euro, and thus, the slightest change in the exchange rate affects the country a lot.

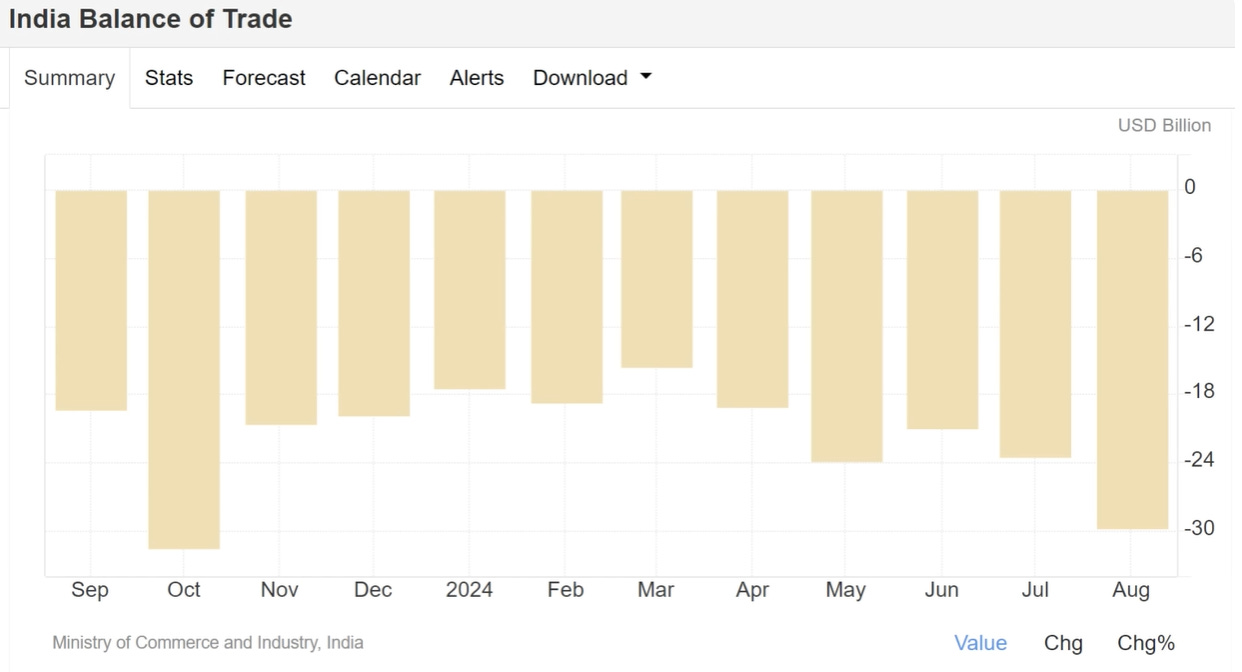

Look at this visual showing India’s Balance of Trade below:

P.S.: Balance of trade = Country’s Exports — Country’s Imports

If you notice the pattern, our balance of trade has been increasing but not the way economies like it. Our imports have been increasing and as said earlier, we need foreign currency to facilitate those imports. The fact that the balance of trade has been growing in a negative way doesn’t help India’s case.

The Inflation Threat

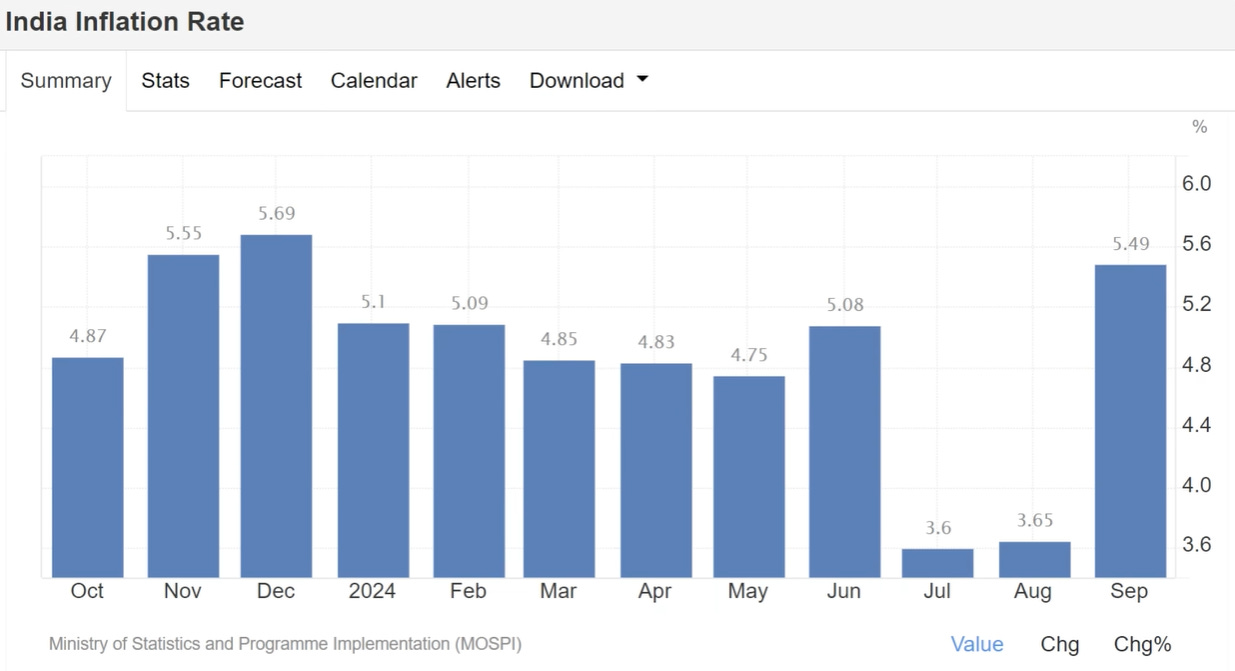

A big plunge in the value of the rupee has an adverse effect on many things and one of those is consumer price inflation. A lot of goods and services we use in our everyday life are imported. Because mera joota hai Japani aur patloon Inglistaani! So, when imports become costlier, so do many other products leading to higher inflation. Here’s another visual for you, India’s inflation:

The inflation data as of September has come out to be way higher than our 4% target rate. With the rupee’s value crashing so much lately, inflation has become a very real threat to our economy. With a crashing rupee, it’s very likely that inflation will go up. This also means that the rate cut that’s being expected from the central bank may not come anytime soon.

Currency Trade

Much like commodities, currencies are also traded in international markets. In fact, currencies make for one of the most traded assets. They are usually traded by big banks, very often central banks amongst others. In that trade, USD is the most traded currency while the rupee makes for only 0.7% of total currency trade. This is a clear indication of INR not being a favored currency, at all!

Foreign Outflows

In October 2024, Indian markets saw a fund outflow worth 1.1 lakh crore rupees. This sudden outflow was a reaction of FIIs to China’s new stimulus package. The package that aims to revive the Chinese economy and get it running once again. FIIs saw some potential in the Chinese economy and flocked to the country with their funds. This outflow, not only increased the supply of the rupee massively but also created turbulence in the Indian equity markets. Equity markets and economies, are both influenced by foreign investments and a withdrawal as huge as what we’re seeing right now alters a lot of things for a country. This month too, FIIs have sold worth 27 thousand crore rupees.

On the brighter side, domestic investors: both retail investors and DIIs are keeping the markets afloat by buying in similar quantities as FIIs are withdrawing.

The Trump Factor

Some people are viewing the crash in the rupee not as a depreciation of the rupee, but as an appreciation of the dollar (different perspectives to view the same things you see). Up until the US elections, the markets were expecting Trump to win, thus strengthening the US dollar a little bit. And when Trump actually won, the strength of the dollar only increased making the Dollar Index rise and the value of other currencies in relation to the dollar fall. This is because it’s expected that Trump’s presidency will strengthen the American economy.

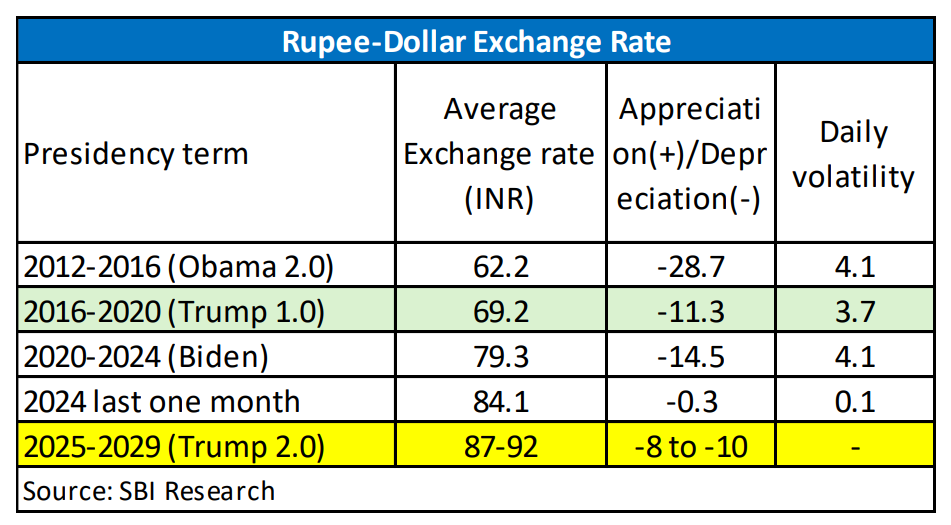

SBI just released a report where this is being talked about. It measured how much the rupee has depreciated under each American president’s term and it looks like Trump has been the least bad for India.

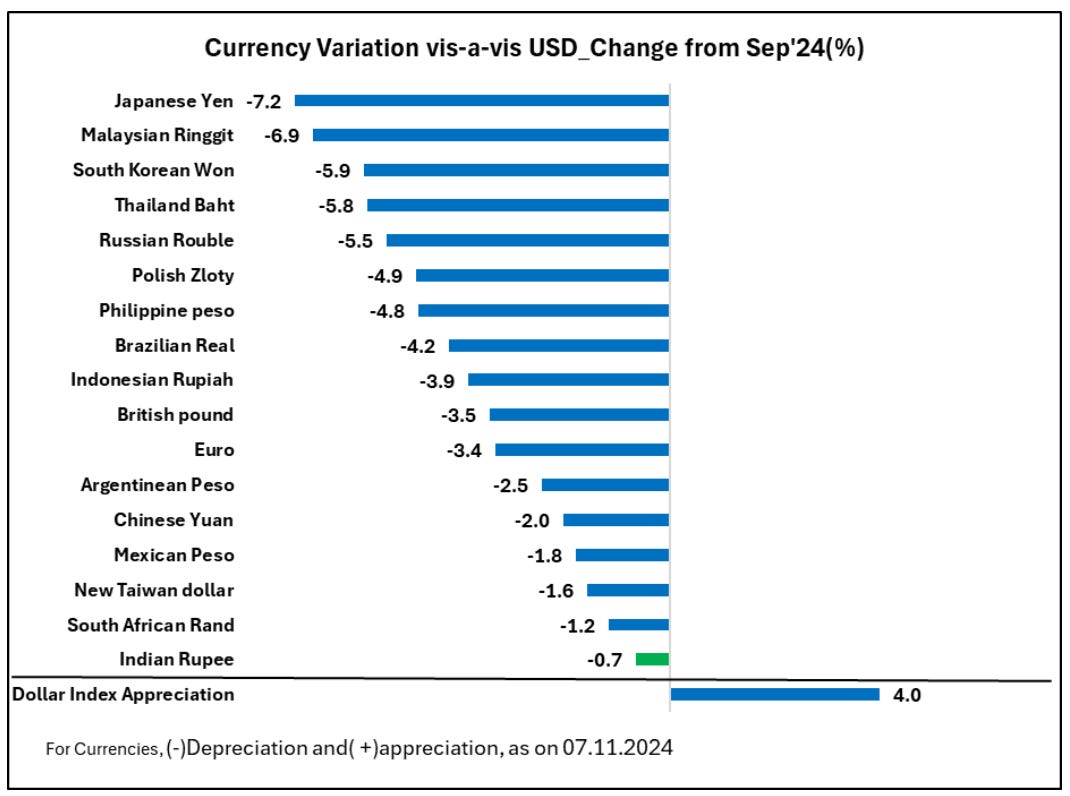

The report predicts an 8-10 depreciation over Trump’s second term (this is a conservative number btw). The report also shows a pretty picture of the Indian rupee falling less as compared to other emerging market currencies while the dollar strengthened. See here:

The Brent Crude Angle

As you might already know, India imports most of its fuel required. However, with geopolitical tensions in the middle east and Russia-Ukraine, the prices of oil have been rather turbulent. Right now Brent Crude is at a low price but even the slightest of geopolitical movement can change things. And when the oil prices go up, India’s import value will go up too and this again would mean trading in foreign currency leading to a weaker rupee.

How’s it impacting businesses?

This one is a mixed bag. As imports become expensive, import-oriented sectors like oil and gas, aviation, metals, mining, and more, as expected take a blow. However, a depreciation in the currency helps increase exports. This helps sectors like IT and pharma which get most of their business from overseas. Buyers get more for the same price when importing from India now and that helps raise exports. However, this impact is not as magnificent as we’d want it to be. In all, the silver lining is very thin.

A Classic Demand-Supply Conundrum

You see foreign outflows, increasing imports, and fewer exports - they all point towards an excess supply of rupees and demand for other currencies. Since almost everything around us is managed by the demand and supply function, the increased supply of rupee posed a problem and as a result, we now see a decline in its value. However, the demand-supply equation is beatable, by RBI, and RBI has been taking actions to stabilize the currency. Let’s see how.

RBI’s Manipulation

RBI, the apex bank of India, has been making transactions in the open foreign exchange markets to keep the rupee stable. How? With our managed floating exchange rate system.

Understand that every country has its own exchange rate system - some countries determine the price of their currency by just demand and supply rules, while others might be decided fully by the government. An understanding of the exchange rate systems is the prerequisite for understanding what RBI is doing right now. While there are many systems, I’ll just tell you about the managed floating exchange rate system. In this system, the value of the currency is primarily decided by the demand and supply phenomena of the foreign exchange markets, but the central bank or government is allowed to intervene if the currency value goes to extremes.

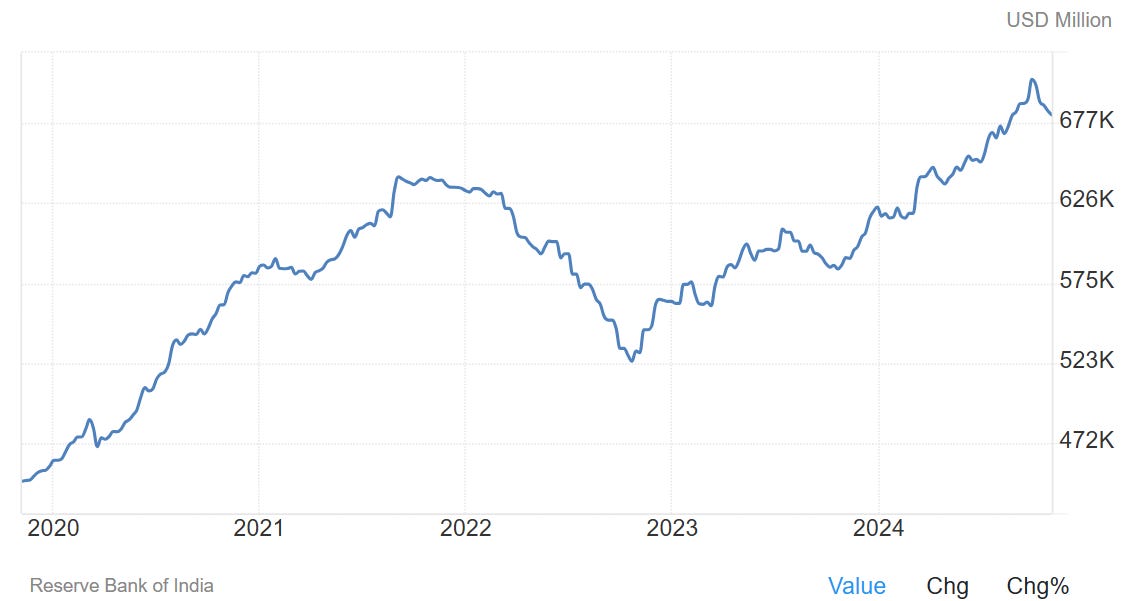

RBI is using its right to intervene now when the value of the rupee is going downhill. Over the last four years since COVID, RBI has been building reserves. See how the reserves peaked in the last week of September to reach 705k USD Million:

Now take a look at the chart again and see the sharp blip since the peak in September. In the first week of October, RBI started selling the dollar reserves: basically selling dollars to buy rupees. As of November's first week, the RBI sold dollars for the fifth consecutive week since October which itself outlines the problem. In these five weeks, the RBI has sold a whopping 20 billion dollars to buy INR in the forex markets.

Anyway, this is being done to alter the demand and supply equation by buying rupees to revive the demand and stabilize the Indian rupee. Some global entities call this sort of intervention “manipulation” but actually, it’s needed by the economy to stay stable.

Impact On The Common Indian

Finally, let’s about the impact the rupee’s value can have on us. You shouldn’t worry much because currently, the depreciation in the rupee is not expected to have much of an impact on the common Indian citizen. But there is an indirect impact in the way that if you are taking a trip overseas, that would become more expensive, if you have a child studying in the US, they would need more funds from you now. If the trend of a crashing rupee stays intact for a longer time, it will eat up into the imports, raising inflation concerns. However, since we do most of our transactions in INR already, there isn’t much of an impact that can be felt by people like you and me.

From the Wise Investor 🤓

"Time in the market beats timing the market."

— Ken Fisher

That’s all from me today, see you again soon!

Yours Truly,

Isha