From Tariffs to Oil: The Next Phase of U.S. Protectionism

For Indian markets, both transmit through the same channels: crude prices, current account pressures, and export volumes.

2025 saw the second term of Donald Trump as the President of the US. The year was defined by tariffs imposed on the countries accused of flooding cheap goods to the US markets.

As part of a promise to his voters, Trump imposed tariffs high enough to make imported products uncompetitive in the US market, with the aim to protect local jobs and products.

India has been, and still remains, one of the most affected countries due to the tariffs, as both countries have not agreed on the terms for a trade policy. Yet.

2026 is expected to be even worse, as Trump’s protectionist policies have now taken a geopolitical edge.

Let’s see how that happened. But first, let’s understand how other countries dealt with Trump’s tariffs.

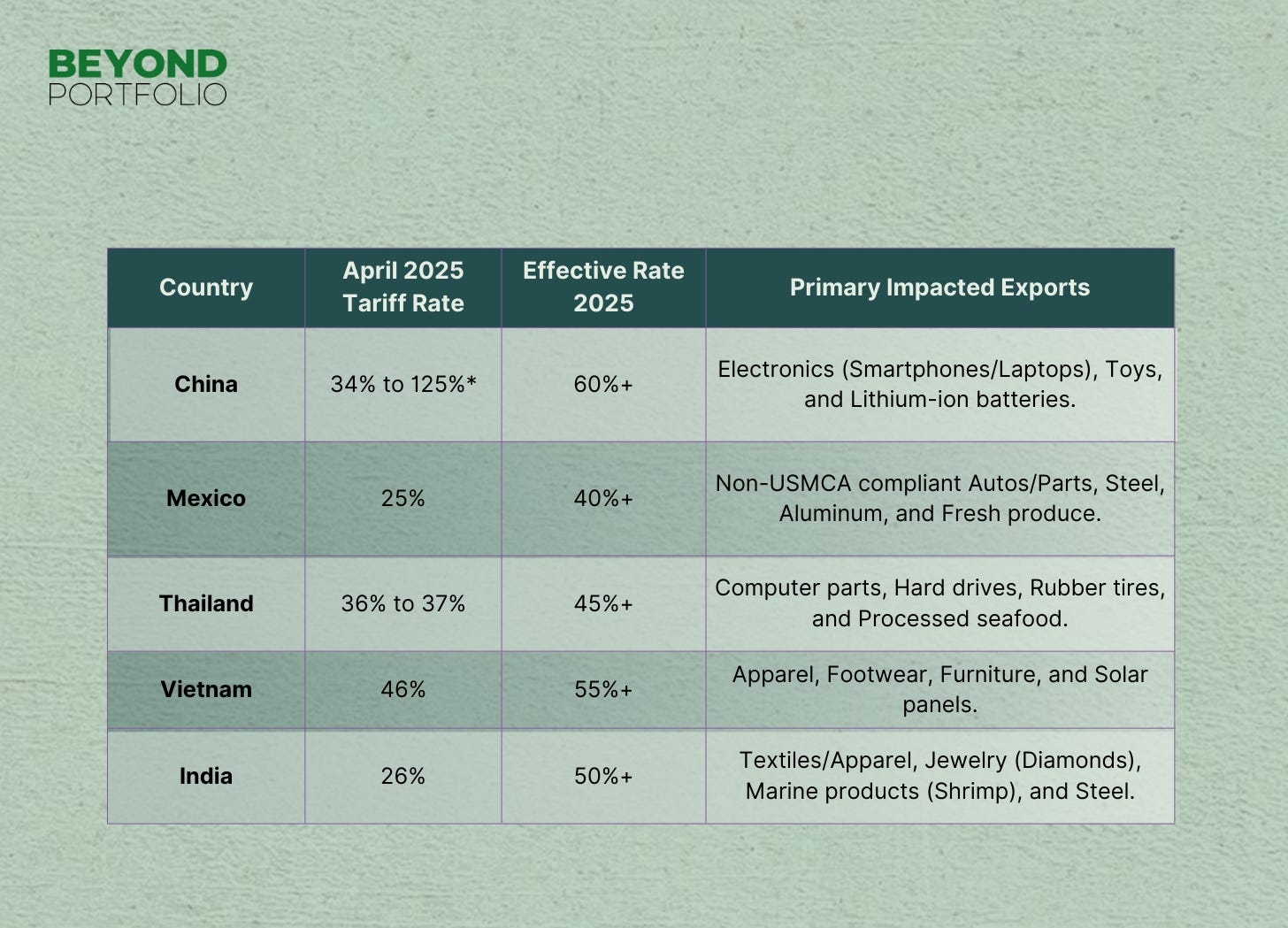

The tariffs that defined 2025:

Following these announcements, the affected countries reacted by either tit for tat tariffs (in the case of China), or lobbied with the US government for trade deals to protect their interests. Vietnam, Mexico and Thailand all agreed to cooperate with the US, either through trade deals that opened their markets to US goods or by addressing the US’s concerns. India remains the only country that has not signed a trade deal with the US yet.

That’s remained an unsolved challenge. Mostly because the most affected sectors - Textiles/Apparel, Marine Products and Gems and Jewellery - have not recovered from the stinging tariffs, yet. Most of these products now have tariffs in excess of 50% of their values, making it impossible for them to even think of exporting to the US.

The Tariff Fallout

India’s gems and jewellery industry is a case in point. Exports to the US attracted very low duties (usually under 7%) till 2024. In April 2025, Donald Trump announced a 10% baseline tariff on loose diamonds and gold jewellery from India. The US accounted for almost 30% of India’s gems and jewellery exports until then. In August, another 15% reciprocal tariff was added on this, with another 25% ‘penalty’ tariff specifically for India, as a ‘punishment’ for purchasing Russian oil.

The result? A 75% drop in shipments by late 2025, with some exporters squeezing their margins to absorb a part of the tariffs. From almost $11.58 billion worth of gems and jewellery exported to the US, this resulted in a decline of exports to just $2.7 billion till November 2025.

For the almost 1.3 million diamond artisans employed in Surat and Mumbai, that meant losing their livelihoods, as workshops curtailed production due to expanding inventories and increased order cancellations. For the diamond market that processes and polishes almost 90% of the world’s diamonds, this meant focusing on alternative markets like China, UAE and Belgium, even as intensifying competition squeezed margins even further.

The industry is yet to recover from this challenge, even as negotiations for a trade deal have been in the news, but have gone nowhere.

5 channels from US protectionism to Indian markets

Oil price volatility affects inflation expectations and RBI policy sensitivity

Current account deficit pressures increase rupee risk and FII flow sensitivity

Gems/textiles/marine exporters face volume and margin compression

OMCs experience marketing margins and inventory effects

Fertiliser/chemicals encounter crude derivative input cost changes

The unimaginable threat: 500% tariffs

To step up pressure on India to completely halt its purchases of Russian oil, Trump, on January 7th 2026, has gone a step further, approving the ‘Russia Sanctions Bill’ that is due to be taken up by the US Congress after January 13. The bill proposes 500% tariffs on countries buying Russian oil, according to Senator Lindsey Graham.

“They [India] must stop buying Russian oil. And I believe almost every single member of this committee has co-sponsored Senator Graham’s legislation which has proposed a 500% tariff on secondary purchase and reselling of Russian oil. The President has only imposed a 25% tariff [thus far],” he said in a press statement.

If this Bill does get passed by the Congress, this would wipe out India’s entire $120 billion exports to the US, analysts fear. For now, this remains a pressure tactic, as the US Supreme Court is expected to hear a case questioning the legality of Trump’s tariffs. That decision has not come as of January 10. If it does, India will be forced to toe Trump’s line to protect its exports.

2026: The next phase of protectionism

The US is not done yet. With the public’s attention to Trump’s tariffs losing steam by the end of 2025, the US President directed his attention to Venezuela’s President Nicolas Maduro. As a known US critic, Trump has repeatedly accused Venezuela’s President of harbouring terrorist leaders of drug cartels. On January 2, Maduro and his wife were taken into US custody by the military, who brought him to the US for a trial.

Though widely considered illegal under international law, Donald Trump has said the U.S. would

“run the country until such time as we can do a safe, proper and judicious transition.”

In a press conference following Maduro being taken into custody, Trump suggested that the US aims to govern Venezuela temporarily, while the US oil companies invest in new infrastructure in the country. Unlike the highly expensive Iraq or Afghanistan wars, Trump said governing Venezuela “won’t cost us anything”, given that the country has the world’s largest oil reserves.

How Venezuela defines Trump’s next actions

The country’s Orinoco belt is estimated to hold more than 300 billion barrels of recoverable oil, the largest globally.

In his first term, Trump had imposed sanctions on Venezuela, effectively blocking the Latin American country from the global oil markets since August 2017. In the eight years since, most buyers have moved to the Middle East or Russia.

Leading OMCs, including Chevron (US), Repsol (Spain), Rosneft (Russia), and India’s ONGC, have seen their Venezuelan investments gathering dust, with payments frozen ever since. ONGC alone has seen almost $500 million frozen due to the sanctions.

If things go according to Trump’s plans, Venezuela’s oil (and its economy) is expected to re-enter the global markets, with the US blessing. Though it’s too early to say what could happen at this point, the US is hoping to install a government that will view it favourably and facilitate oil and ore shipments from the country.

Though it’s too early to predict how things could go, Venezuela is not the same as Iraq or Afghanistan. Besides oil, the country is blessed with vast untapped natural resources. According to a report in 2018, this includes:

3 billion metric tonnes of Coal reserves

3.6 billion metric tonnes of iron ore

99.4 million metric tonnes of bauxite

644 tonnes of gold

These untapped reserves come at a time when demand for them can outstrip supply, and every untapped reserve is a resource that cannot be ignored.

With oil prices directly affecting almost everything we use, the re-entry of Venezuelan oil (and other resources) into the international markets could affect our everyday lives. Greater supply of oil can mean cheaper petrol, lowering inflation and ultimately encouraging interest rate cuts by the RBI. If oil supply continues to be limited to only a single source (sans cheaper Russian oil, leaving only Middle Eastern suppliers), the limited supply could mean lower money left at the end of the day.

For Trump, having control over Venezuela is more than just protectionism, it is a masterstroke that adds geopolitics, pragmatism and a desire to maintain its status as the world’s leading superpower.

It solidifies his resolve to ‘Make America Great Again’, especially as China asserts its dominance as the world’s newest superpower.

Disclaimer: This newsletter is for informational and educational purposes only and does not constitute investment advice or an offer/solicitation to buy or sell any securities. Views expressed are based on publicly available information as on the date of publication and may change without notice. If any past performance or return figures are mentioned, they are for context only - past performance may or may not be sustained in the future. Please consult a qualified financial adviser before making any investment decision.

Really interesting analysis connecting the tariff pressure with the Venezuela oil play. The 500% tariff threat on Russian oil purchases is basically economic coercion to realign India's energy sourcing, but the Venezuela angle adds another layer since it gives the US a carrot (access to Orinoco crude) alongside the stick. What strikes me is how this shifts from trade policy to resource diplomacy, the OMC frozen assets angle ($500M for ONGC alone) shows how sanctions create these multi-year investment hangovers that complicate future energy security planning for countries like India.