Ozempic in India: The economics of fat loss

Pharma players are hoping to launch Semaglutide based Weight loss drugs to boost their fortunes

2.2 billion.

That’s the number of overweight people in the world, according to the World Obesity Atlas 2025. Until 2017, a lifestyle change with regular exercise, a controlled diet and avoidance of tobacco and alcohol being the primary cure.

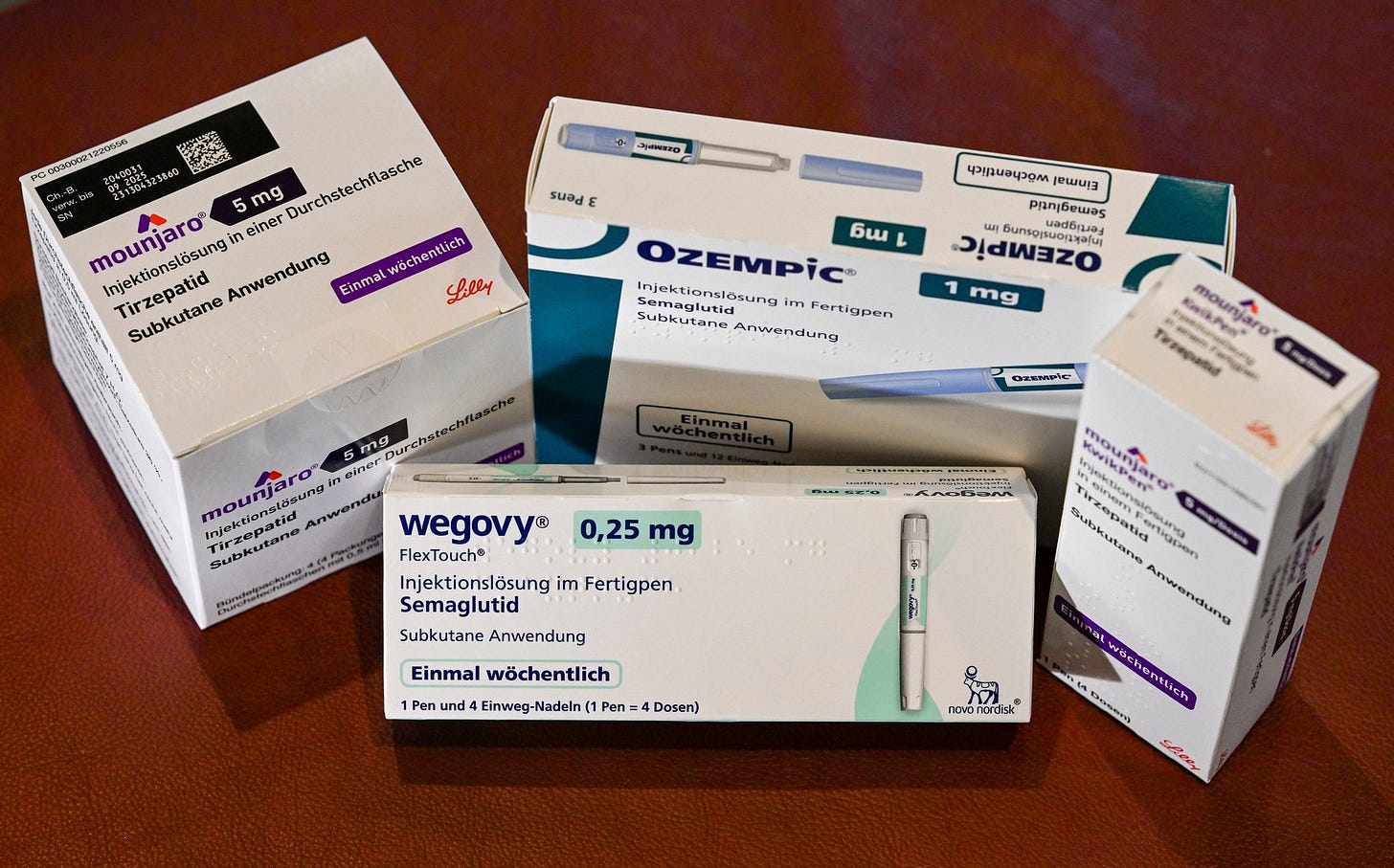

All of that changed when the FDA approved Novo Nordisk’s Ozempic - a drug based on the Semaglutide molecule - that had proven effective for patients to lose about 10-15% of their weight.

But Semaglutide wasn’t supposed to be a weight loss drug. Novo Nordisk had been researching molecules to treat ulcer disease, and eventually Type 2 diabetes, until Phase 2 trials showed the effectiveness of Semaglutide as a weight loss drug.

The Ozempic Effect

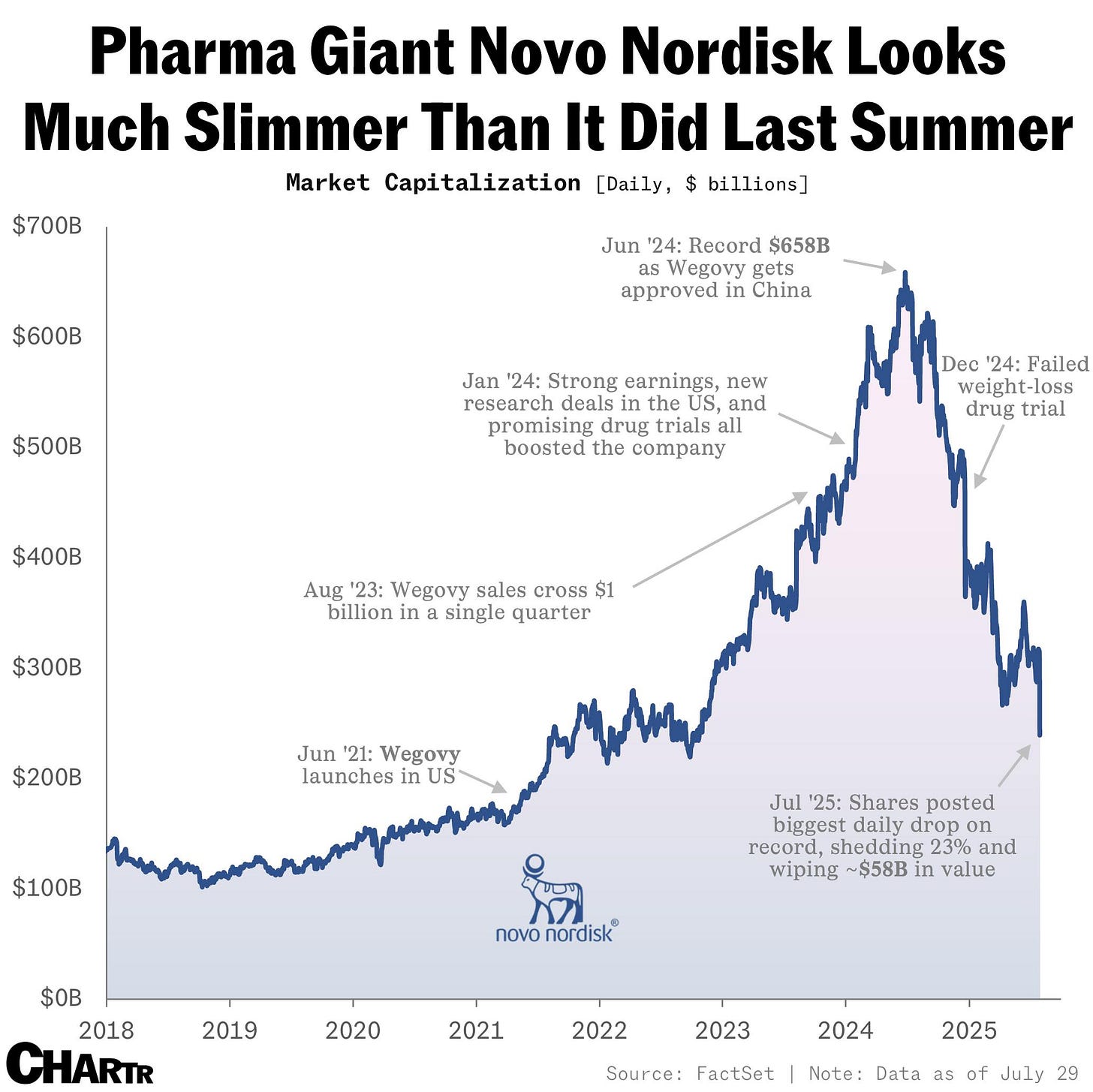

In the eight years since, Ozempic’s popularity has skyrocketed to a level where Novo Nordisk had to take unprecedented ramp ups for its production. This included investing almost $10 billion to expand production in Denmark and the US, while its parent Novo Holdings bought contract manufacturer Catalent for $16.5 billion to use its facilities to process its drugs into injection pens.

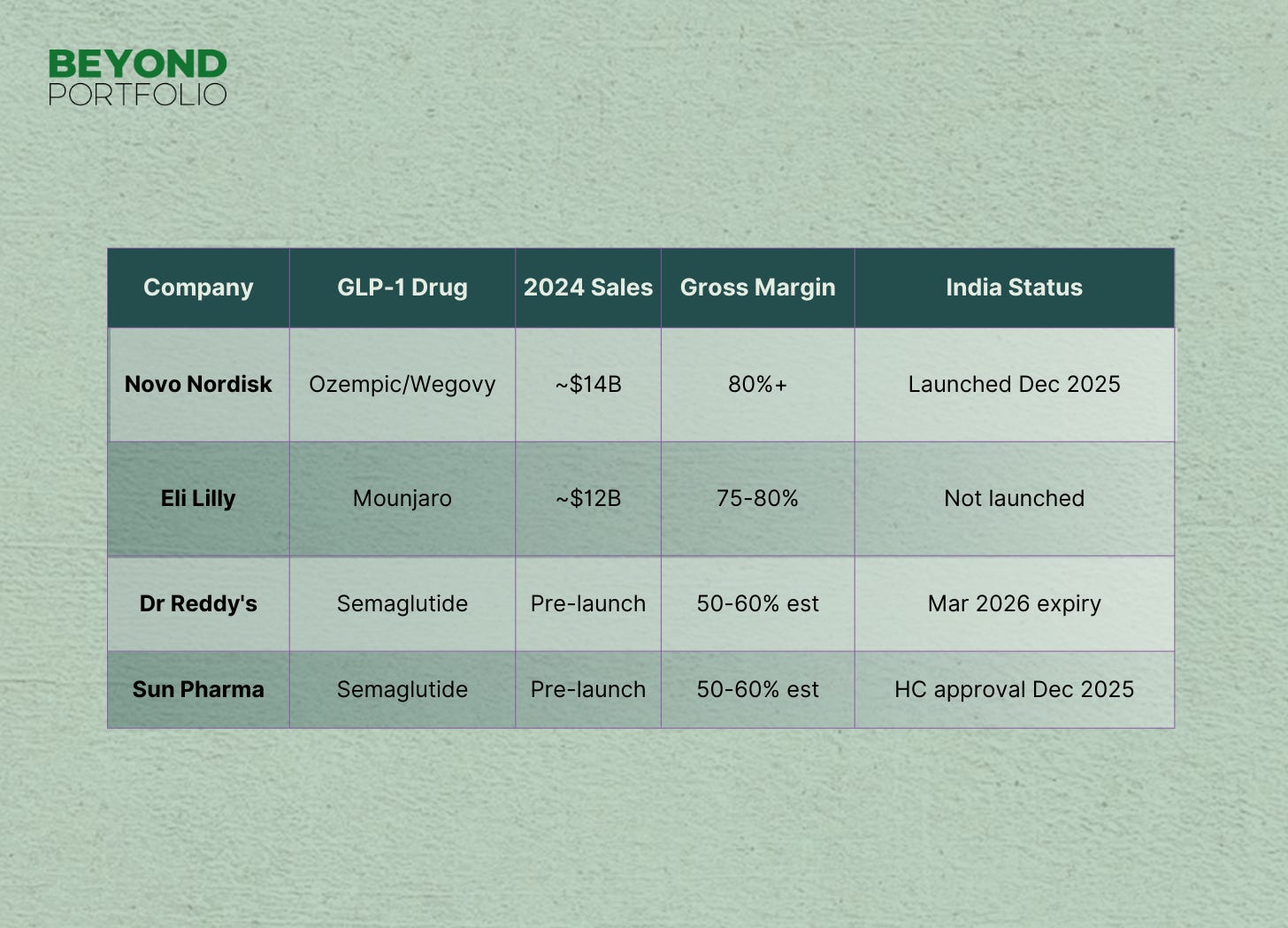

For Novo Nordisk, these investments have paid off handsomely. GLP-1 sales from Ozempic and Wegovy reached approximately $14 billion in 2024 alone, driving 25% revenue growth for the company. Novo Nordisk earns high gross margins of around 80% on these drugs despite substantial capital investments.

Ozempic helped Novo Nordisk reach a market cap of $658 billion in June 2024, though the prices have dropped since. Its main rival, Eli Lilly, has gone even further, with its market cap becoming the first pharma company to briefly reach a $1 trillion valuation on the back of its Mounjaro weight loss drug.

Indian Pharma jumps on the bandwagon

Ozempic was launched in India on December 12, 2025 at Rs.8,800 per month. The formulation patent is expiring in India in March 2026.

Considering that, Indian pharma companies have jumped on the bandwagon, aiming to get the first mover advantage. Zydus, Torrent Pharma, Sun Pharma, Cipla, and Lupin are amongst the contenders for rolling out a cheaper version of Ozempic.

With an estimated 100 million Indians suffering from Diabetes and another 180 million being overweight, semaglutide offers an opportunity that none can afford to miss.

From the US to the world

Until now, Novo Nordisk has mostly earned its revenues from the US market, mainly on the back of the drug’s high list price of about $935 per dose, while in Germany or the UK, it is often under $150 due to pricing restrictions.

While Ozempic is sold globally as a diabetes care product, its sister brand Wegovy has grown almost 40% year on year in the US, mostly on the back of its weight loss branding.

But the dream run is slowly coming to an end for Novo Nordisk, as competing brands like Eli Lilly’s Mounjaro and other off brand versions enter the fray.

Given that the global GLP-1 agonists market is expected to reach $100 billion by 2030, rival pharma companies are not far behind, even though differing pricing regulations may not allow them to earn the almost 35% margins Novo realised in the US.

Even though Novo’s patent is expected to expire in March 2032, differing patent treatments has allowed domestic pharma companies like Dr Reddy’s and Biocon to sell generic versions of Semaglutide in developing markets in Asia and Africa.

The reality of Ozempic’s ‘shortcut’ cure

The convenience of taking a weekly injection to control your weight has been the main reason for Ozempic’s popularity. Celebrity endorsements and social media frenzy boosted its popularity, with an estimated 12% of Americans taking the drug (or those similar to it) at some point in 2025.

Despite almost 45% of users experiencing side effects like nausea, vomiting and muscle loss, many continue to take the injections without making an effort to supplement it with healthy food and an active lifestyle.

According to studies, almost 90% of those who’ve taken the drugs report regaining their weight within a year, forcing them to continue with the weekly injections, especially if no efforts are made to modify one’s lifestyle.

How Semaglutide could disrupt existing industries

Currently, bariatric surgery is the main medical intervention used to address obesity, where the excess fat is surgically removed. In 2024, India’s bariatric surgery market was worth $300 million, with almost 20,000 surgeries performed in the last 5-7 years.

For patients who haven’t been able to lose weight conventionally, taking a weekly injection is far more convenient than going under the knife. It is only a matter of time until the bariatric surgery industry could get affected by Semaglutide, even though serious cases will require surgery.

Though prices are expected to come down, it remains to be seen how the Indian market will respond to this global sensation. Novo Nordisk saw its shares rise on the back of burgeoning demand and its first mover advantage. For Indian pharma companies, replicating this success isn’t going to be easy, given the competition already in the pipeline. For them, the timing, scale and pricing of the launch will dictate any upward trajectories in its share prices.

3 questions for Indian markets:

Can generics capture 70% share by 2027?

Will diabetes patients convert to weight loss?

Lifestyle change requirement equals adherence cliff ahead?

Let’s answer these in the comments.

Disclaimer: This newsletter is for informational and educational purposes only and does not constitute investment advice or an offer/solicitation to buy or sell any securities. Views expressed are based on publicly available information as on the date of publication and may change without notice. If any past performance or return figures are mentioned, they are for context only - past performance may or may not be sustained in the future. Please consult a qualified financial adviser before making any investment decision.