NRI Investment Guide 2025 by Expert Capital Advisors

The only guide you need in 2025

If you are an NRI working overseas and carefully saving a bulk of its earnings, you must have wondered: "Should I invest in India, and if yes, how?"

Amidst all advice from well-wishers and generic blog articles, it must seem difficult to find personalized actionable advice. Whether you're a newcomer or an old hand, this newsletter cuts through the chaos with an exhaustive roadmap for NRIs in 2025 - crafted by experts from our fund house who have been guiding NRIs for over a decade now.

Why invest in India?

Let’s start with a simple question: why should NRIs think about investing in India?

It’s easy to focus on the investment trends in Western markets, but India offers a much stronger opportunity. It is not just about the emotional connection you may have to your homeland, because India is moving forward quickly as an economic powerhouse. GDP growth is projected at 6.5-7% over the next few years, compared to about 2% in the US and only 1-1.5% in the UK.

Consider this real-world example: if you had invested ₹10 lakh in a Nifty 50 index fund ten years ago and done nothing else, your investment would now be worth around ₹35-40 lakh. That’s market-matched returns without picking a single stock.

What’s more? You have a key advantage that foreign investors don’t have: your firsthand knowledge of the Indian market. You know which banks people trust, which grocery chains lead in urban retail, and which food-delivery apps have earned consumer loyalty.

Core Foundation: Essential NRI Accounts

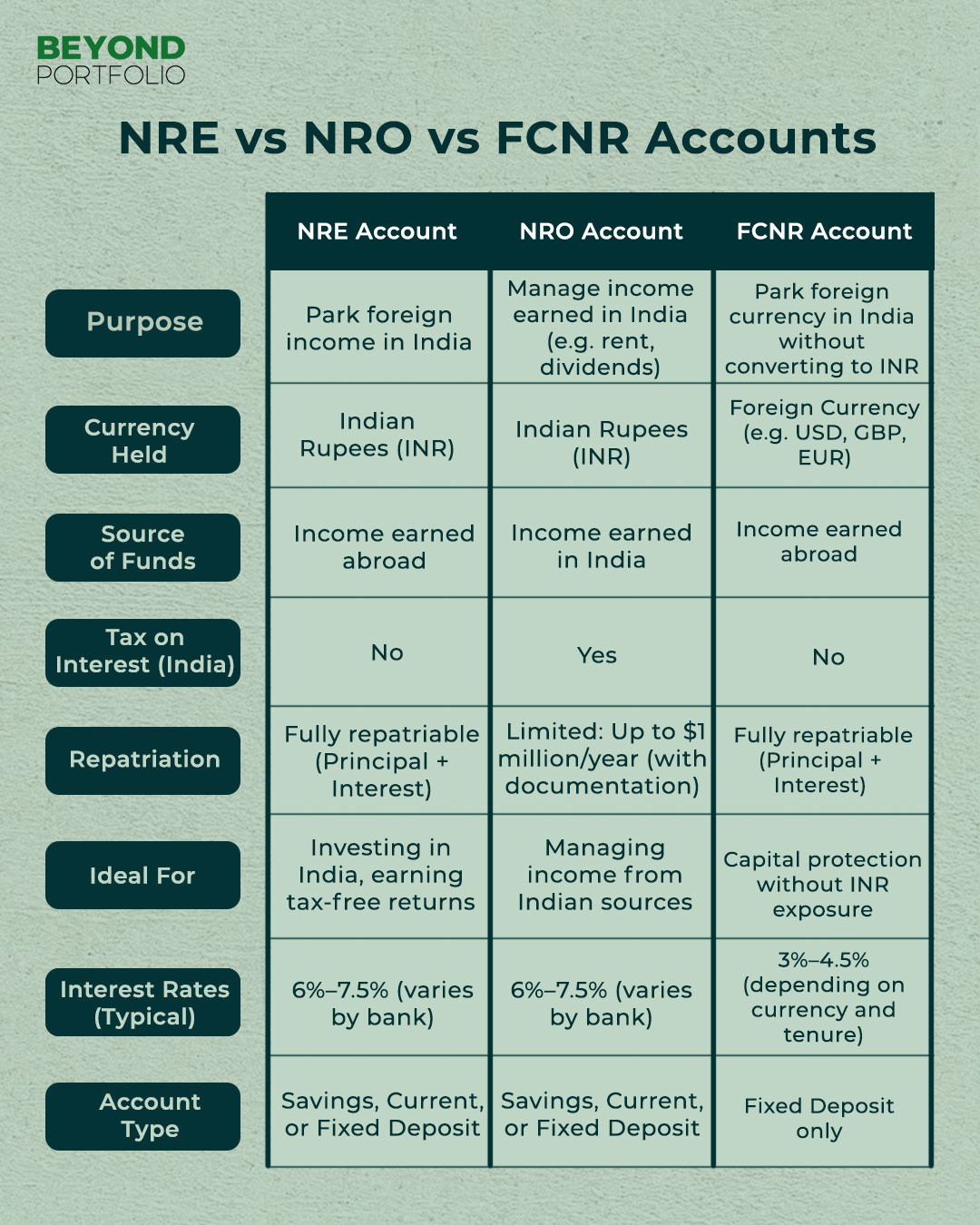

Before you begin investing in India, you must establish the right banking infrastructure. Three account types form the backbone of any NRI’s financial toolkit: the NRE account, the NRO account, and the FCNR account.

A Non-Resident External (NRE) account is funded with foreign-earned income and held in Indian rupees. Interest on an NRE account is completely tax-free in India, and the principal and interest can be repatriated (sent or brought back to India). This means that you can transfer funds out of India at any time. This makes the NRE account ideal for parking foreign earnings, invest in Indian assets, or hold rupees temporarily before deciding what to do with them.

By contrast, a Non-Resident Ordinary (NRO) account is used to manage money you earn in India, like rent, dividends, or pension. Although the money in an NRO account is also held in rupees, interest earned here is taxable. Repatriation from an NRO account is more restrictive: you can remit (send) up to US $1 million per financial year, and each transaction requires submission of Forms 15CA and 15CB (often facilitated by your chartered accountant).

Finally, a Foreign Currency Non-Resident (FCNR) account allows you to deposit and earn interest on funds held in major foreign currencies (USD, GBP, EUR) within India.

Because the principal and interest remain in the original currency, you avoid any exchange-rate risk, and the interest you earn is completely tax-free in India. For NRIs seeking pure capital protection without rupee exposure, FCNR accounts offer an ideal solution.

Now that your account structure is in place, let’s explore the best investment options:

NRE Fixed Deposits

– Deposit your foreign-earned income in an NRE account FD.

– Interest rates: 6-7.5% (tax-free, fully repatriable).

– Rupee depreciation can reduce your dollar or pound returns to around 3–4%.FCNR Fixed Deposits

– Fixed deposits in your chosen foreign currency.

– Interest rates: 3-4.5% (tax-free, zero conversion risk).

– Best for ultra-conservative investors seeking absolute currency stability.Indian Mutual Funds & ETFs

– Professionally managed pooled investments in equity, debt, or hybrid strategies.

– Index funds (Nifty50, Sensex) offer low fees and market-matching returns.

– Flexi-cap and hybrid funds provide diversified growth with moderate risk.

– Invest via your NRE/NRO account on platforms like Coin (Zerodha), or ICICI Direct.

Invest Smartly with Mutual Funds & ETFs

When it comes to genuine wealth creation, mutual funds and ETFs are the most accessible, professionally managed vehicles. By pooling your capital with other investors, these funds deploy it across a diversified portfolio of stocks, bonds, or a combination of both. For NRIs who have confidence in India’s long-term growth story but prefer not to research individual companies, mutual funds offer an ideal solution.

Start with index funds, which simply replicate major benchmarks such as the Nifty 50 or Sensex. These passive funds charge minimal fees and deliver market-matching returns. As you become more comfortable, you can explore flexi-cap funds which balance large-cap, mid-cap, and small-cap stocks for higher growth potential or hybrid funds that blend equity with debt for moderated volatility.

So, Investing is straightforward: open your NRE or NRO account on platforms like Zerodha Coin, or ICICI Direct, select the funds that align with your risk profile and horizons, and set up a systematic investment plan (SIP) to automate your contributions.

Points to Be Careful Of:

US/Canada residents: Indian mutual funds may trigger complex and costly PFIC tax rules in your home country. So, always check both Indian and local tax laws before investing.

Platform limitations: Not all investment platforms (like Groww) support NRI mutual fund accounts - confirm eligibility with the platform first.

Tax on dividends and gains: Dividends and capital gains from Indian funds are taxable in India for NRIs, and you may need to file Indian tax returns.

Restricted fund options: Some Indian funds and ETFs are not available to NRIs from certain countries - always check fund house policies before investing.

Visiting India soon? Here’s your curated checklist for you to avoid any legal or financial hassles.

Your to-do list is just a click away (and don’t worry, we hate spamming).

Diversify with Flexi-Cap and Hybrid Funds

Index funds are just the beginning. If you seek higher growth, consider flexi-cap funds, which allocate your capital across large-cap, mid-cap, and small-cap companies based on market conditions. For those who prefer moderated volatility, hybrid funds blend stocks and bonds to balance growth with lower risk.

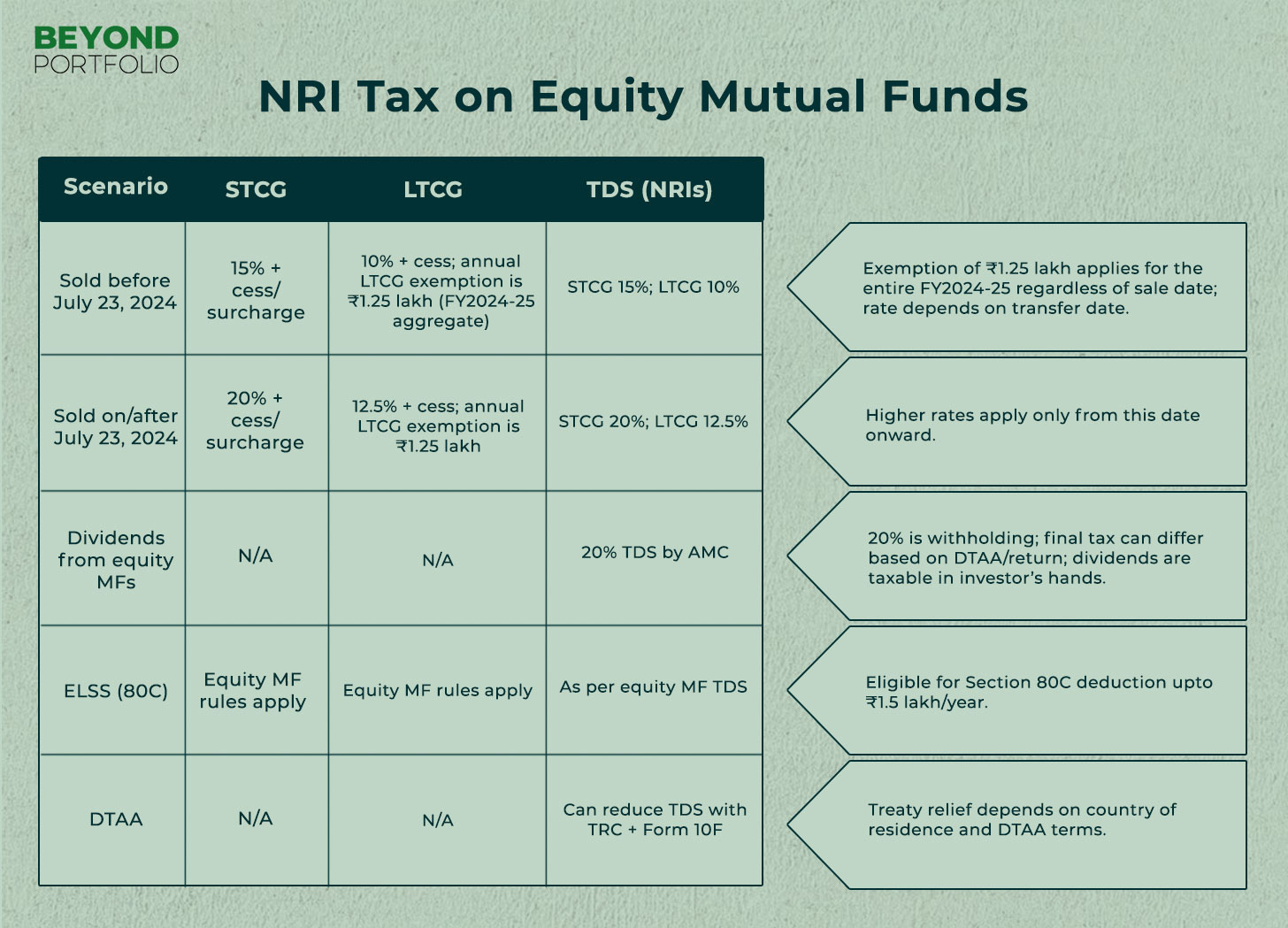

Tax rules also diverge: flexi-caps and equity hybrids attract 20% short-term capital-gains tax and 12.5% long-term gains above ₹1.5 lakh for NRIs, while debt-oriented hybrids are taxed at your slab rate if held under three years and at 20% with indexation thereafter; all variants withhold 10% TDS on NRI redemptions and tax dividends in India, so you may still need to file an Indian return.

US and Canada-based NRIs face an added hurdle - Indian mutual funds are usually classified as PFICs, triggering annual Form 8621 filings and punitive tax, so many fund houses simply refuse their subscriptions.

Tax Implications for Equity Mutual Funds

Understanding taxation on mutual fund gains is crucial for NRIs. If you sell equity mutual fund units within one year, your profit is classified as short-term capital gains (STCG). As of the July 2024 budget, STCG on equities is taxed at 20%, plus applicable surcharge and health and education cess - up from the previous 15%.

Hold those units for more than one year, and any profit qualifies as long-term capital gains (LTCG). Fortunately, the first ₹1.5 lakh of LTCG in a financial year is exempt. Gains above this threshold are taxed at 12.5%, without surcharge or cess.

PFIC Caution for US/Canada Residents

As mentioned earlier, if you reside in the US or Canada, Indian mutual funds may be treated as Passive Foreign Investment Companies (PFICs). PFIC rules may make you pay tax on gains that exist only on paper each year, even if you never sell your units, which adds complexity and extra cost. If you fall into this category, consider investing through GIFT City platforms or US-listed ETFs instead, which avoid PFIC classification.

Direct Equity Investments

As an NRI, you have the option to invest directly in Indian stocks. To do so, open a trading and Demat account linked to your NRE or NRO bank accounts. Leading brokers—such as Zerodha, ICICI Direct, and HDFC Securities—offer NRI-compliant trading platforms. Direct equity investments grant you full control over your portfolio, allowing you to research and select companies based on your own due diligence.

Taxation on gains mirrors that of mutual funds: 20% short-term capital gains if sold within one year, and 12.5% long-term capital gains (above a ₹1.5 lakh exemption) if held longer than one year.

Portfolio Management Services (PMS)

For investors with ₹50 lakh or more to deploy, Portfolio Management Services (PMS) offer a fully outsourced, customized investment solution.

A professional manager runs your money, adjusting it to fit your goals and risk profile. Your shares sit in a demat account in your own name, so you can view everything and keep the tax benefits. Your money can go into many places - big or small-cap stocks, bonds, REITs, commodities and even some unlisted deals, for better diversification.

You receive clear monthly or quarterly reports that show every position and its performance. Finally, you choose whether the manager trades freely (discretionary), acts only after you approve (non-discretionary) or simply gives advice (advisory). This route is ideal if you prefer to have an expert handle all aspect of your investments.

GIFT City - India’s Global Financial Hub

GIFT City lets NRIs invest in Indian and overseas assets directly with foreign currency. Because GIFT City sits in a special economic zone, investments made there pay no Indian tax, allow money to be taken out freely, and avoid PFIC issues, which could be an appealing setup for NRIs in the US, UK, Canada, and elsewhere. Leading platforms such as Stockal, HDFC IFSC, Kuvera Global, and Westpac’s Wested let NRIs invest easily in Indian stocks as well as global shares, ETFs, bonds, and more.

For NRIs seeking a clean, tax-efficient investment route, GIFT City stands out as a key choice.

Real Estate - Lifestyle or Investment?

NRIs are permitted to purchase residential and commercial properties in India (agricultural land is excluded). However, residential real estate often yields only 2.5% rental returns - for instance, a ₹1 crore Mumbai apartment may generate just ₹20,000–25,000 per month, while EMIs can range from ₹80,000 to ₹90,000.

Additionally, when you sell property, the buyer deducts 20–30% TDS on the full sale price. You can reclaim any excess via your tax return, but sending more than US $1 million abroad in a year needs RBI approval. Unless you plan self-occupancy or gifting to family, or view real estate primarily as a lifestyle purchase.

That said, tier 2 and tier 3 city hotspots with emerging infrastructure can offer lucrative land and commercial property opportunities, particularly for NRIs with local market insights and on-the-ground knowledge of upcoming developments.

Common Pitfalls NRIs Must Avoid

Even seasoned investors can stumble over basic mistakes when managing cross-border finances. First, don’t confuse your account types: an NRE account is tax-free and fully repatriable, whereas an NRO account is taxable and subject to repatriation limits. Mixing these up can lead to unexpected tax liabilities and transfer hurdles.

Second, remember that tax rules vary by country. Just because an investment is tax-exempt in India doesn’t mean it enjoys the same treatment in the US, UK, or Canada. Always check your resident country’s regulations to avoid surprise tax bills on your foreign earnings.

Third, filing Indian tax returns is not optional if you earn over ₹2.5 lakh in a financial year, even as an NRI. Ignoring this requirement can result in penalties, interest, and compliance headaches down the road.

Fourth, never buy property based on emotion alone. Always calculate the rental yield, estimate your monthly EMI, and factor in exit taxes before committing. Emotional purchases often become money pits rather than wealth generators.

Your Four-Step Action Framework

Clarify Your Return Plans

Decide whether you plan to eventually move back to India or retire abroad. This influences your choice of accounts, investment vehicles, and repatriation strategy.Choose the Right Mix of Accounts

Use NRE accounts for investments and foreign earnings, NRO accounts for India-sourced income, and FCNR accounts for capital protection in foreign currencies.Match Products to Your Goals

– Short-term goals (0–3 years): FCNR or NRE fixed deposits

– Medium-term goals (3–5 years): Hybrid and balanced mutual funds

– Long-term wealth (5+ years): Equity index funds, direct stocks, Gift City, or PMSMaintain Compliance

File your Indian ITR, report foreign assets as required by your resident country, and enlist a qualified cross-border tax advisor when in doubt.

India remains one of the most exciting investment destinations globally if you understand the rules. You don’t have to rush or become an expert overnight; you just need the right guide. With clear planning and disciplined execution, you can harness India’s growth story to build enduring wealth.