IPO Boom 2026: Bubble, Opportunity, or Both?

With 2025 being a watershed year for the stock markets, investors are hoping for that to carry that for 2026 as well.

2025’s IPO frenzy raised ₹1.95 lakh crore, and the pipeline for 2026 is being talked up at more than ₹2.5 lakh crore.

But here’s what made 2025 a little more complicated than the headlines suggested: a lot of money went into IPOs on hope, not on clarity about how the business would actually deliver returns.

Many investors subscribed under the mirage of high growth and eventually, high returns, prodded by friends, family and aggressive marketing networks, fuelled by pure FOMO.

Questions like: How will the company use my money to expand its business? How will it navigate the challenges in the markets? And most importantly, will I actually get what I think I will? Are seldom considered, if not at all.

Many of these investors may have had these questions after the stock prices fell, turning their hopes into despair. They can’t do anything at the time, even as others are quick to point out the successful IPOs, and the mistakes they made while investing.

They can only hope the company turns around, and helps them earn the elusive returns they think they will get, someday.

This year, almost 190 companies across telecommunications, fintech, e-commerce, financial services, and consumer sectors are looking to raise funds, promising to invest in their operations or pay off their debts.

Given that many have burnt their hands by investing the the wrong companies, will investors continue to invest in 2026 as enthusiastically as last year? Or will the hype driven bubble still continue?

Let’s understand it in detail.

2025: The year round IPO party

Despite the challenges with the economy, 2025 has been a cheerful year for companies and investors, as Opportunity offered them a chance like no other.

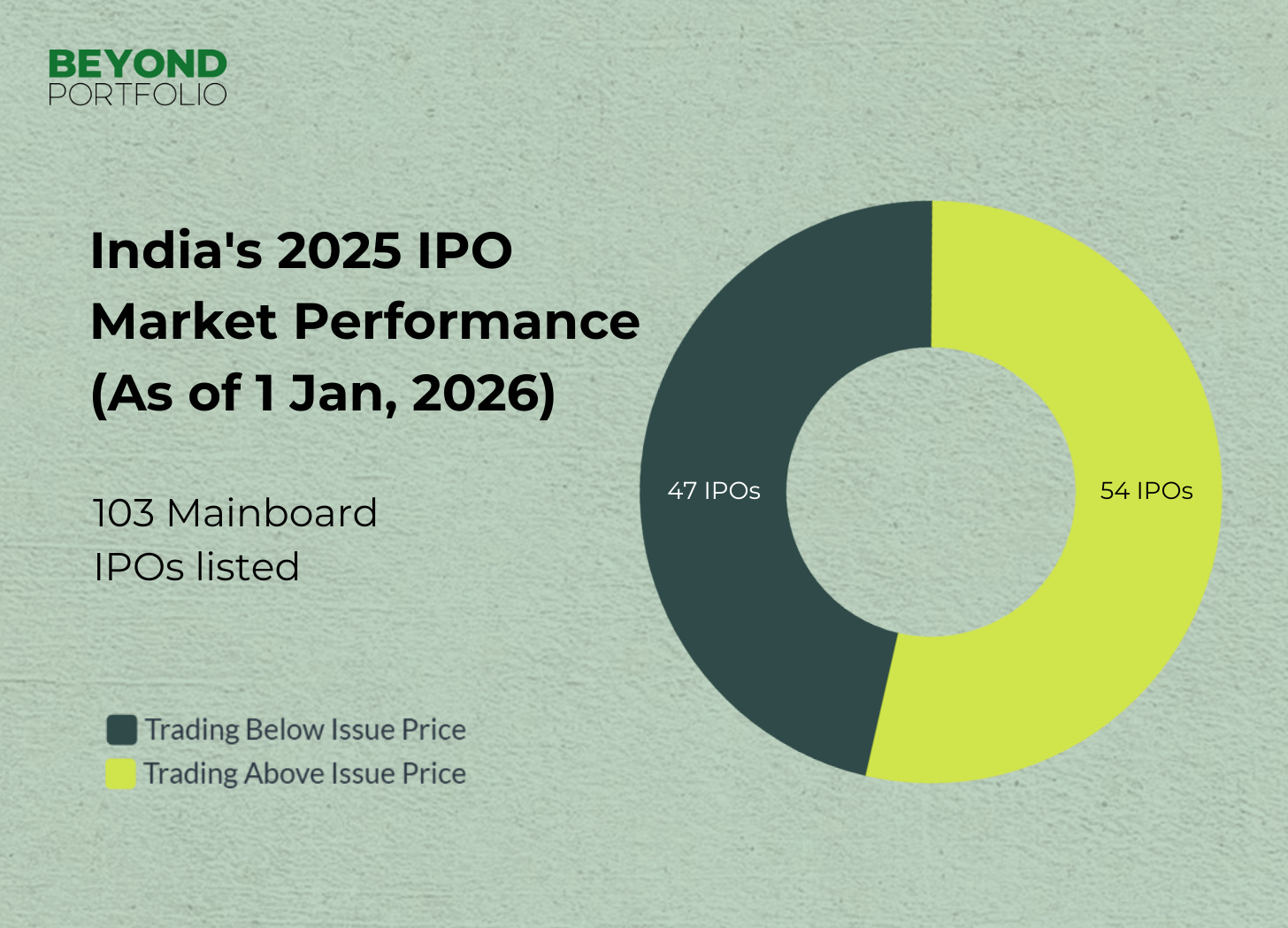

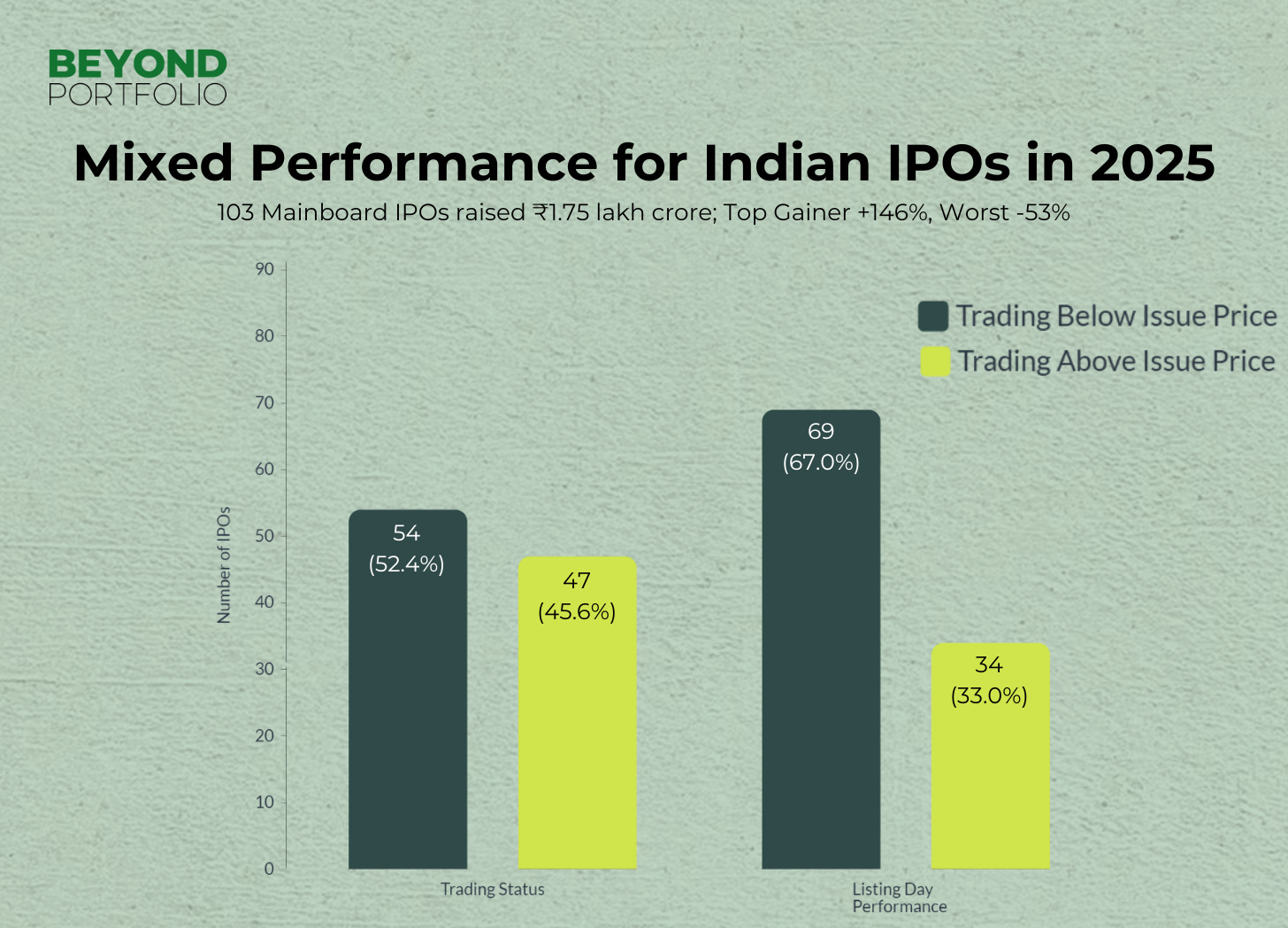

Throughout the year, 373 companies raised about ₹1.95 lakh crore from the public, who hoped for better returns.

Nearly 50% of the newly listed companies are still trading below their listed prices, while only a few, Ather Energy, Meesho and LG Electronics India, the most well known of the lot, have actually offered double digit returns.

For the rest, investors are hoping for better days, in some cases a miracle, as they watch their investments cautiously.

How should an IPO be an opportunity (typically)?

Usually, companies use IPOs to raise long term capital for its business or let investors gain early access to businesses that were previously not available in the public markets. High potential companies, like Reliance Industries Limited (RIL) had earlier used IPOs to raise funds from small town investors, giving them an opportunity to raise further capital from sources other than banks.

In 1977, the predecessor to RIL, Reliance Textile Industries Limited, raised ₹2.8 crore through the markets, a transformative step at the time. Today, a ₹1,000 invested then would be worth more than ₹64 lakh today. For Dhirubhai Ambani, that IPO helped him fund his backward integration strategy, moving from textiles into petrochemicals, refining and eventually telecom and retail under Mukesh Ambani.

For existing shareholders, the IPO typically offers them an opportunity to liquidate their holdings at better terms, as many are early investors or employees who held stocks as collateral. In their place come new investors, eager to invest in a highly promising company who can offer inflation beating returns.

How can an IPO turn into a bubble?

Companies tap the public markets only when they have a genuine need to do so. In many cases, this could be cheaper than debt or venture capital as they are not time bound to meet payment terms or milestones to raise additional funds.

The challenge lies when the IPO becomes a convenient reason to raise funds without strings attached, riding on investors hopes. That’s what happened for the much hyped 2008 Reliance Power IPO to raise ₹11,563 crore. Back then, investors trusted Anil Ambani and the Reliance brand, despite the company not having any operational assets. After listing at ₹530, the stock collapsed to ₹372, with hapless investors facing losses just because they believed the brand and not the metrics.

Today, Reliance Power is trading at about ₹30 despite the company turning around its fortunes from the low of about Re.1.20 March 2020.

For the investors who bought into the IPO 17 years ago, that still means losing 93% of their initial investment!

Will it turn out to become both?

The answer lies in distinguishing signal from noise.

The biggest challenge will be if there are companies that offer the genuine potential for returns going public at the same time as those riding on hype. In such cases, many novice investors may not be able to differentiate between the two. For them, the relative success of the IPOs in 2025 would be enough to blindly invest in new IPOs without making an informed decision.

Disclaimer: This newsletter is for informational and educational purposes only and does not constitute investment advice or an offer/solicitation to buy or sell any securities. Views expressed are based on publicly available information as on the date of publication and may change without notice. If any past performance or return figures are mentioned, they are for context only, past performance may or may not be sustained in the future. Please consult a qualified financial adviser before making any investment decision.