Ultimate NRI Guide to Beat Currency Volatility in 2025

Every fluctuation in the USD-rupee exchange rate ripples beyond the headlines, it directly impacts the financial lives of Non-Resident Indians (NRIs).

NRIs often earn in dollars or other currencies, but they may use it to cover costs back home in rupees- like helping out parents, paying for a kid's education, or saving for a house. That means any little shift in the dollar-to-rupee exchange rate directly tweaks how much their earnings are really worth when transferred.

For example, earlier this year when the rupee dropped from about ₹84.8 to ₹86.5 against the dollar, sending $100,000 home suddenly got you around ₹170,000 more in rupees. On the flip side, that same dip shaved roughly 2% off the dollar value of any Indian stocks or real estate you already owned, eating into your overall investment gains.

Historical data shows the rupee typically depreciates against the dollar by an average of 3-5% annually since 2000, and 5-10% in turbulent periods, such as the 8% swing in 2022 due to the Ukraine war. Ignoring this can influence your total wealth, though it doesn't always outweigh market movements (For e.g. Sensex have delivered long-term annual returns of 10-15%).

Why the Rupee Moves Against the Dollar

economic factors coming together, like the US Federal Reserve's decisions, and differences in inflation rates between countries. India's prices have typically risen 2-3 percentage points faster than in the US each year, which gradually erodes the rupee's value, averaging about 3-4% depreciation annually since 2000.

On top of that, India's ongoing trade deficit, its heavy dependence on imported oil, global tensions and even the overall political vibe that can shake investor confidence and ultimately decide how strong or weak the rupee will be.

Visiting India soon? Here’s your curated checklist for you to avoid any legal or financial hassles.

Your to-do list is just a click away (and don’t worry, we hate spamming).

What Rupee Swings Really Mean for NRIs

For Non-Resident Indians pulling in income from stronger currencies like the dollar, a dip in the rupee's value can feel like hitting the jackpot without lifting a finger. For example, take your typical paycheck sent back home. Earlier this year when the rate dipped from about ₹83 to ₹85 against the dollar, sending $100,000 home gave roughly ₹8.5 million instead of ₹8.3 million- an extra ₹200,000 to spend. That kind of boost can easily sponsor grand family celebrations, better healthcare for aging parents, or act as a cushion against skyrocketing education costs.

This ripple effect extends to bigger purchases too, especially in real estate where prices are mostly in rupees. A softening rupee effectively slashes the cost in dollars for something like a high-end apartment in Mumbai, potentially saving you tens of thousands. Using that same exchange shift, the extra rupees might let you splurge on a prime spot, add fancy interiors, or even go for a bigger place altogether.

Now of course, it's not all upside.

If the rupee bounces back and gains strength, things can swing the other way. Selling assets or bringing money back later might yield fewer dollars than expected, and until lately, it could even bump up your tax liabilities.

Why FCNR Deposits Belong in Every NRI Toolkit

Wondering how Non-Resident Indians can stash their cash in India without worrying about the rupee's ups and downs? That's where Foreign Currency Non-Resident (FCNR) deposits come in handy (we talked about in it details in our previous Newsletter LINK) they're like a safe haven compared to regular NRE or NRO accounts that get hit by currency swings.

Basically, you park your money in a strong foreign currency, such as US dollars, euros, pounds, yen, or a few others approved by the Reserve Bank of India. This means your deposit's value only changes based on that foreign currency's movements, and not every little shift in the rupee's exchange rate against it. So, if the rupee drops 6-8% in a year, your savings stay protected, saving you from losing a chunk of your wealth to those fluctuations.

At its core, an FCNR is just a straightforward fixed-term deposit, lasting anywhere from one to five years. The whole thing- your initial amount, the interest you earn, and what you get back at the end, stays in that same foreign currency from start to finish.

Banks offer rates that follow global trends; right now in August 2025, something like Deutsche Bank is giving 5% on a one-year USD deposit or 4.75% for two years, which often beats out similar US Treasury options and skips any US state taxes.

So, picture this: If you put in $100,000 at 4.75%, it'd grow to about $109,500 after two years, no matter what the rupee does in the meantime. Plus, the interest isn't taxed in India, and you can send the full amount back overseas whenever it matures (no strings attached).

There are some smart rules that make it even more user-friendly. If you end up moving back to India and become a resident, the RBI lets you hold onto your FCNR until it naturally ends, keeping your agreed-upon interest rate intact. Lots of banks will even let you borrow against it in rupees (at a small markup over your deposit's rate), so you can grab some quick cash without touching the principal, which keeps earning interest.

When speaking about volatility, time is the most important factor to look into - but it’s about more ways than we discussed so far.

Lining up large remittances with predictable life events like your child’s semester fees, a mortgage tranche, SIP dates, help you work out good rates without having to guess the market. And some of there fall closer in the timeline than others.

Risk-averse savers are indeed moving toward FCNR fixed deposits, but here are some loopholes:

Lock-in: All FCNRs carry a statutory one-year minimum. Breaking the deposit earlier makes you lose the entire year’s interest, while premature closure after twelve months usually attracts a 0.5–1 percentage-point penalty. Partial withdrawals are not allowed.

Yield band: Major banks quote 3.8 - 5.5% on one-year USD blocks in August 2025 (SBI 4.2%, DBS 4.0%, IDBI up to 5.2%). Only a few second-tier banks touch 5-5.8%, so treat 4-5% as the realistic, not universal, range.

Liquidity: Because the principal and interest stay in foreign currency, FCNRs suit long-term dollar goals or a safety reserve, not short-term rupee spending.

Now, here is your ultimate guide onto planning your money:

Short-Term Rupee Expenses: For funds you'll need soon (like rent or tuition), keep them in an NRE savings account or a very short-term rupee debt fund. These are in rupees, so they align directly with your upcoming INR-based costs, avoiding exchange rate surprises.

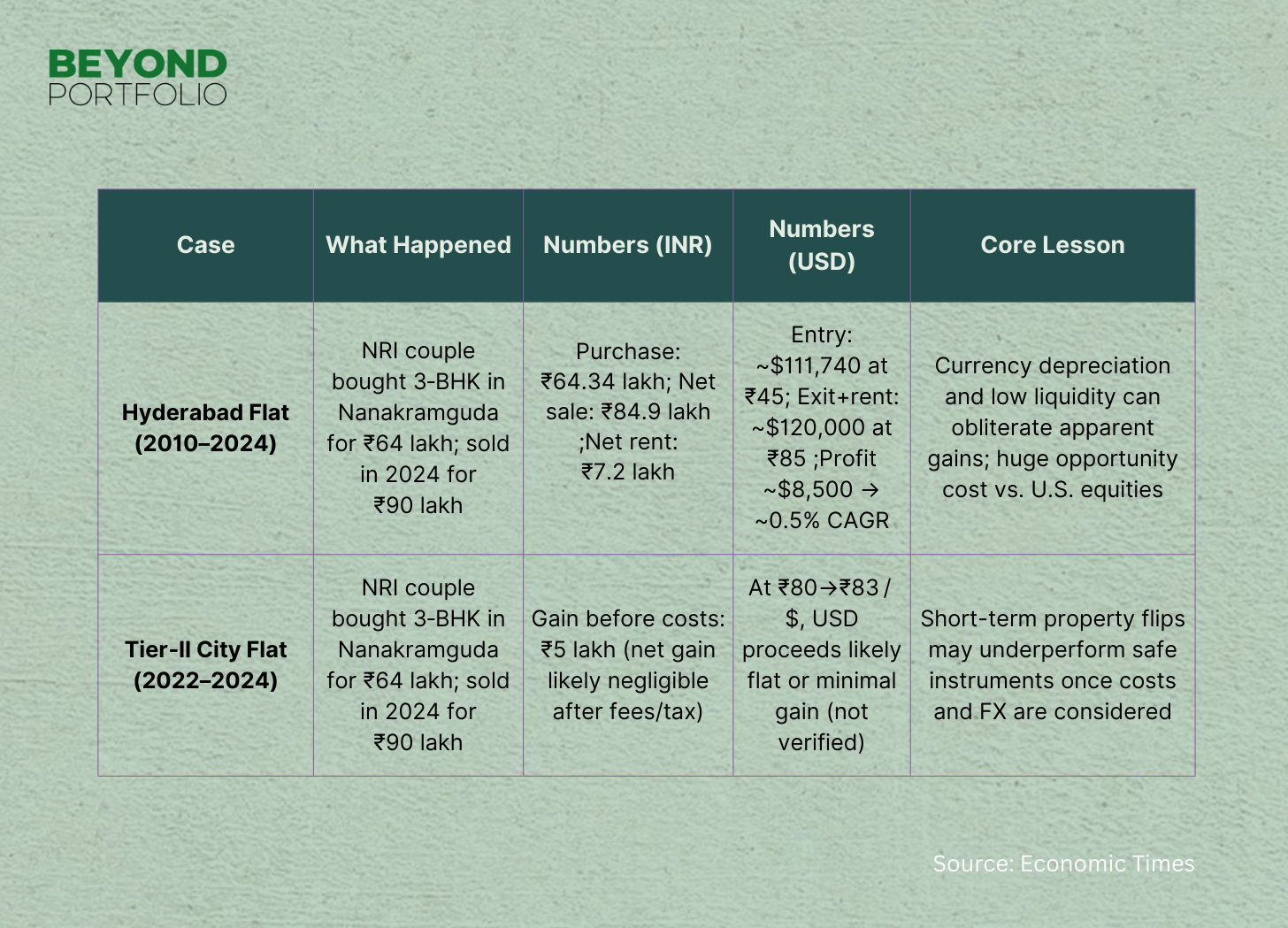

Long-Term Investment Plays: For goals 10+ years on, consider Indian stocks, REITs, or private lending options, but run the math: From 2013-2023, Indian equities grew at around 10.6% annually in INR terms, but with the rupee depreciating about 4.3% yearly, the effective USD return dropped to roughly 6%, lagging behind the S&P 500. Focus on undervalued opportunities, mid and small cap funds rather than just India's growth story to make it worthwhile.

Secure Major Rupee Commitments: For predictable big expenses like education fees or mortgages, use USD-INR forwards or futures to fix the rate. Be smart about costs: In 2024-2025, a six-month hedge might run 1.2-1.5% due to interest differences, plus 0.1-0.2% in charges, aim for under 0.5% only on brief terms or when rates align favorably.

Rebalance with Care: Adjusting portfolios across countries every few months incurs fees like wire transfers, India's TCS on outbound remittances over certain limits, and—if you're in the US—extra reporting under PFIC or FATCA rules. Ensure the potential benefits from reallocating outperform these hurdles.

Putting Volatility in Perspective

The rupee's yearly range exceeded 6% in 2020, 2022, and 2024, but dipped to just 2% in 2023. Factor this into your hedging decisions- major swings aren't given annually.

Stick to these guidelines, and exchange rate changes turn into a predictable element of your strategy, not an unpredictable threat.

Finally, keep perspective on volatility itself. By timing your investments wisely, adding protective hedges, and diversifying across geographies, NRIs can ride out the market turbulence they hear about on the evening news.