FIIs Are Losing Faith in Indian Markets, Should You Too?

Here’s the whole truth behind markets' worst freefall in 29 years

In the early 1990s, countries like Indonesia, Thailand, Malaysia, the Philippines, and South Korea saw a flood of foreign capital flowing into their economies. Why?

Deregulated markets, rapid industrialization and cheap capital.

As a result, stock markets soared, businesses thrived, and currencies strengthened.

But in 1997, without much warning, the same foreign investors who had once eagerly poured money into these economies suddenly pulled back. Why?

Overextension of credit, coupled with inadequate financial oversight.

This swift and brutal retreat led to a stock market crash, currency devaluation, and panic spread across the region like wildfire.

The economies now struggled to stay afloat. The crisis deepened and spread like a domino effect pushing many other developing nations into economic distress. The scars of the crisis remained even after years of surface-level ‘recovery’.

In South Korea, the $170.9 billion fall in 1998 was equal to 33.1% of the 1997 GDP! Even worse, years after this, international investors were still reluctant to lend developing countries, leading to economic slowdowns in developing countries in many parts of the world.

This story you just read is popularly known as the ‘Asian financial crisis’!

Many economists debated whether foreign investments were a boon or a bane, but one thing was clear-

Understanding the real impact of these capital flows was crucial back then, and it is crucial today!

Something similar happened in India this February too..

FII outflows are making headlines everywhere. So, the other day my little NRI cousin asked me

“Why are FIIs such a big deal?”

I explained-

If the stock market is a grand party, the FIIs are the VIP guests!

Their presence lights up the room, attracts others and the party thrives. But when they start leaving early, it’s hard not to notice. The music feels quieter, the energy dips, and suddenly, people wonder if it’s time to head out too.

That’s how impactful FIIs are to the markets- their moves can change the mood of the entire "party", affecting investor confidence, market stability, and overall economic momentum.

In India, FIIs contribute to about 20% of the total turnover at the National Stock Exchange (NSE) of India. This means that out of every ₹100 traded, ₹20 involves foreign investors!

FIIs offloaded a humungous 1 lakh crore from Indian equities and a series of reactionary events unfolded.

BSE Sensex: A year-to-date decline of over 5.41%

Nifty 50: Marked as the worst performing global market in 5 months

AUC: Dragged to an 11-month low standing at ₹64.78 lakh crore

Sell India, Buy China: Hang Seng index surged by 18.7%, contrasting with Nifty's 1.6% decline

Rupee Depreciation: Indian rupee depreciated nearly 1.50% making it the 2nd worst performing Asian currency

Whys and Hows

Many of you thought our Hon’ble Finance Minister, Nirmala Sitharaman, too might find herself in “rough seas”,

just like British Prime Minister, Liz Truss, did with her “transformative” budget that “costed” her, her job, in 2022 (simply because she couldn’t justify all the tax cuts)!

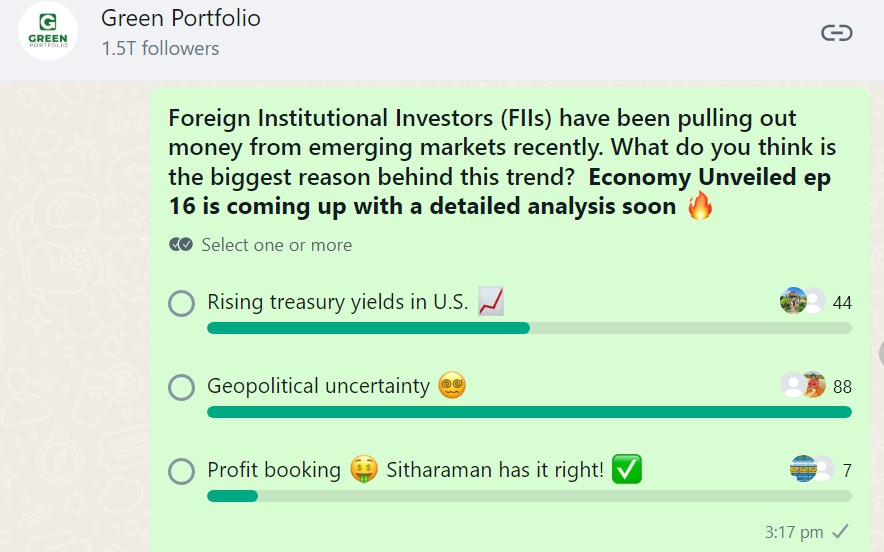

For context, this is a screenshot of a poll from our WhatsApp channel where keep you updated with the latest Financial News, Insights, Newsletter and other updates in the most interesting way possible.

Yes, so basically, Sitharaman said that everything is hunky-dory, the markets are cherry-blossoming, and that’s why FIIs are booking profits and abandoning India. If that's not true, mind you, let’s not pin it all on our FM alone, after all, economic magic tricks are a team effort (!dramatic drumroll!).

Now, back from the sarcasm, onto the topic again..

China’s optimistic measures soared hopes

In late September 2024, China unveiled its biggest stimulus package (rate cuts, property sector support, and liquidity injections) since the pandemic.

Chinese stocks are currently considered relatively inexpensive, as indicated by several valuation metrics like the following. If these stocks continue to be cheap, this tactical shift in flows may continue.

In 2025, just after Donald Trump's inauguration as the 47th US President, China's stock market had already emerged as a significant destination for portfolio flows. Hmm.. So apparently, it isn't as sunshine and rainbows for India.

Xi Jinping’s new initiatives with their leading businessmen kindled hopes of a growth recovery in China. Optimistic measures involved monetary easing, fiscal incentives, and policy support that reassured investors about investment scope in Chinese markets.

EMs bled out in the Tariff war

Trump's administration implemented significant tariffs on major nations such as China, Canada, and Mexico, with a 25% duty on Mexican and Canadian imports and a 20% cumulative tariff on Chinese goods. These measures heightened global trade tensions, leading to concerns about reduced economic growth in emerging markets.

This was yet another trigger that drove FIIs to withdraw from emerging markets like India!

We unfolded the trade war story in the last newsletter on Geopolitics of Trump’s economic hammer. Check now!

India’s been slugging along

I bet, they didn’t want you to know this but..

A weaker-than-expected Q2FY25 and Q3FY25 earnings season in India also fueled concerns among investors. The Nifty 50 companies reported a modest 4% year-on-year (YoY) profit after tax (PAT) growth, marking the second consecutive quarter of single-digit growth since the pandemic recovery began in mid-2020.

Key sectors like oil & gas, metals, and manufacturing reporting disappointing results. Companies like BPCL and Oil India Ltd posted sharp declines in profits, while overall corporate revenue growth remained sluggish.

Invest in The 100 year - A low-risk strategy for turbulent times

As a result, FIIs who seek higher returns and stability, shifted their capital to safer assets like U.S. bonds and the strengthening dollar, exacerbating the market downturn.

The total net sales of 3,618 listed companies increased by 7% year-on-year (YoY) to ₹37.73 trillion in Q3FY25, reflecting moderate revenue growth.

It’s hitting hard, but for How long?

Not forever.

Sell China, buy India will be back

Despite the current attractiveness, China's economy faces significant structural issues that could impede sustained growth.

China’s property sector accounts for nearly 27% of its GDP, yet it's facing a severe downturn marked by oversupply, plummeting prices, and declining developer confidence. This isn't just a blip, it's eerily similar to Japan’s real estate bubble burst in the 1990s, which led to decades of stagnation.

Consumer spending in China has weakened significantly, creating deflationary pressures reminiscent of Japan’s "Lost Decade”. Retail sales growth slowed to 5.5% YoY in January 2025, a stark contrast to India's robust 9.2% retail growth in the same period. Weak consumer sentiment and cautious spending are clear signs of deeper economic distress.

Given these structural problems, the "Sell India, Buy China" play feels more like a short-term tactical shift rather than a sustainable strategy.

India’s sluggish growth story is still sustainable

Despite the challenges, India’s growth story remains structurally sound, driven by strong domestic demand, rapid digital transformation, and a robust infrastructure push. Unlike China, where weak consumer sentiment is dragging growth, India’s private consumption contributes nearly 60% to GDP!

India’s digital revolution, fintech innovation, and AI adoption is transforming is unlocking new efficiencies in businesses. Meanwhile, the government’s infrastructure investments are fueling long-term growth. This focus on roads, railways, and urban development directly boosts corporate earnings across sectors, creating a sustainable growth cycle and attracting foreign investments.

Simon will come back

History has recorded that FPIs tend to return to Indian markets once macroeconomic uncertainties subside. A similar trend was observed in early 2023, when outflows reversed following a period of market correction.

A key factor influencing FPI behavior is the U.S. Dollar Index (DXY), which, if it peaks and starts declining, should reduce pressure on emerging markets like India!

A strong dollar typically drives capital outflows from riskier assets, but as the Fed signals rate stability or potential cuts, the dollar’s strength may wane and ease rupee depreciation concerns.

Once currency stability returns and global liquidity conditions improve, foreign inflows are likely to pick up again, reinforcing India’s market resilience.

Tighten your belts, the right way

Chill out,

this isn’t an event-driven panic selling, it’s a valuation-led correction!

Fundamentally, nothing has changed on the ground, corporate earnings remain strong, economic growth is intact, and India’s long-term story is as resilient as ever.

In fact, Domestic Institutional Investors (DIIs) are stepping in aggressively, absorbing much of the FPI outflows. Much to the investor’s relief, historically, whenever DIIs ramp up their buying, markets tend to rebound stronger!

So, as an investor what should you do?

You can

reallocate, not exit. Identify quality stocks that have corrected but still have strong fundamentals.

hold, don’t sell. Selling now means locking in losses—instead, stay invested for the long haul to reap the recovery gains.

continue your SIPs. Selling SIPs in a correction could be a mistake as you could better accumulate more units at lower prices, setting yourself up for long-term gains.

keep your Demat Account. A surge in account closures will shrink market liquidity, affecting recovery speed.

invest with us: Our expert research team will help you invest sustainably.

Join Us Live on YouTube

We understand that turbulent times call for expert guidance. Check out our exclusive Webinar by Green Portfolio’s founders where they will discuss key market insights and the right approach to invest:

Good to know that DIIs are stepping up. Thanks for the write-up.

Agreed to when you said investors should continue their SIPs. Good analysis thanks